After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

As global economic centers gradually shift towards Asian countries, Kazakhstan, Uzbekistan, Kyrgyzstan, Turkmenistan and Tajikistan are claiming increasingly important roles in the current system of global investment flows, resource hubs and supply chains.

Large investment loans in Central Asian countries are becoming increasingly available.

These long-term capital resources play a critical role in building competitive economies and serve as a powerful driver for local and foreign companies expanding their operations in the region.

Infrastructure projects, the oil and gas sector, mining, energy, agriculture, light industry and the recently emerging innovation sector largely depend on the ability of businesses to attract affordable investment loans and organize effective project finance schemes.

GCAM Investment Group offers large corporate clients a full range of professional financial solutions for business development, including investment lending in Central Asia, organizing project finance, leasing instruments and much more. We and our international partners are also ready to assist in the development of new projects on the EPC / EPCM basis, engineering services, financial modeling, project management and much more.

The essence of investment lending and its features

An investment loan is a type of business financing provided to companies, organizations or individual entrepreneurs for the purpose of developing investment projects or operations.The main purpose of an investment loan is to provide funds for the acquisition of assets, business expansion, equipment modernization, construction of new enterprises or other long-term investments that are expected to be profitable in the future.

Investment loans can be provided by commercial banks, international financial institutions, government agencies, investment funds and other sources of capital to stimulate economic growth and development. Investment lending in Central Asia began to develop actively after the collapse of the Soviet Union and the countries of the region gained independence, opening up new opportunities for attracting foreign investment and business development.

The main feature of an investment loan and its difference from other types of financing, such as a working capital loan, is its purpose. Its main characteristics are listed below.

Purpose of investment loan

The main purpose of an investment loan is to finance long-term investment projects and operations that are expected to be profitable in the future.These projects may include new plant construction, equipment upgrades, asset acquisitions, production expansions, or new product development. The main focus is on value creation and business growth.

Long-term financing

Investment loans are usually provided for a long-term period, which can be several years or even decades. This allows the borrower to have enough time to implement the investment project and repay the loan from future income.Security and collateral

Investment loans issued to companies in Central Asian countries, according to local legislation, can be secured by assets that are financed as collateral, which reduces the risk for the lender. In each case, participants need to familiarize themselves with the regulatory features and realities of the local financial sector.Investment nature of financing

It is important to remember that funds obtained through an investment loan should generally be used for specific investment purposes and not for ongoing operations or personal expenses. This provides control and supervision on the part of the lender.Waiting for profit

The main idea underlying the issuance of an investment loan is that the project that is financed with its help should generate profit, which will be used to repay the loan / provide income to borrower.These distinctive features make investment lending more suitable for financing large capital-intensive investment projects and strategic business development, while other types of financing, such as working capital or personal loans, are often used for ongoing operations, the purchase of goods or services, or meeting short-term needs.

Table: Advantages and disadvantages of an investment loan in Central Asia as an instrument for long-term financing of large business projects (general characteristics).

| Advantages of an investment loan | Disadvantages of an investment loan |

| Long-term financing: Investment loans provide long-term funds, which is especially useful for investment projects that take time to pay off. | Debt and interest: The borrower is required to pay principal and interest on the loan, which can create additional financial burdens. |

| Growth and development: An investment loan allows a business to finance its growth, development and modernization, which can help increase profits and competitiveness. | Risk of non-repayment: If the investment project is not successful, the borrower is still obliged to repay the loan, which can lead to financial difficulties and losses. |

| Ownership and control: The borrower retains control of his business because the lender does not usually own an interest in the company. | Need for collateral: In some cases, the lender may require assets to secure the loan, which may increase the risk for the borrower. |

| Tax benefits: In some cases, interest on an investment loan can be taken into account as a tax deduction, which can reduce the tax burden. | Long approval process: Getting an investment loan can take time and require a long approval process. |

Comparison with other sources of business financing:

• Equity. When using equity capital, the business is not required to pay interest and is not exposed to the risk of default, but it can lead to the erosion of ownership and control.

• Real estate mortgage. If the business owns real estate, a mortgage may be available at a lower interest rate, but the risk is loss of assets if the loan is defaulted.

• Equity financing. When attracting investors, a business can receive not only funds, but also experience and contacts, but this may require giving up part of the property.

• Short-term financing. This type of financing can be more flexible and suitable for short-term needs, but usually has higher interest rates.

Each type of business financing in Central Asia has its own unique characteristics and is suitable for different situations depending on the specific needs of the business and its financial strategy.

To find out more about the financial options available to your company, contact GCAM Investment Group.

Central Asia today: new investment opportunities

Central Asia is a geographic region with a population of 76 million people and a total GDP of almost $400 billion, comprising five countries: Kazakhstan, Uzbekistan, Turkmenistan, Tajikistan and Kyrgyzstan.From an economic point of view, this region is characterized by a wealth of natural resources, including oil, gas, uranium and precious metals. These resources play an important role in the economies of Central Asian countries and make them attractive to foreign investors.

From a political point of view, the Central Asian region is a site of important geostrategic interests, as it is located between Russia, China, Iran and Afghanistan. This region is important because of its role in ensuring stability, combating transnational threats, and in the context of competition between leading states for influence and resources in the region.

The countries of Central Asia, despite numerous political and economic contradictions, can be considered as a single economic complex with many fundamental elements that determine the dependence of neighbors on each other.

Hydrocarbons and mineral resources have traditionally been of great investment attractiveness for foreign companies. Two of the five republics, Kazakhstan and Turkmenistan, are largely focused on the production and export of hydrocarbons. On the other hand, Tajikistan and Kyrgyzstan do not have large hydrocarbon reserves and therefore are forced to import fossil fuels. Only Kyrgyzstan has some reserves of thermal coal, but it is not yet able to fully provide its economy with them.

However, the unique advantage of the latter two countries is their significant water potential. More than two-thirds of the territory of these republics is located in the high mountainous regions from which the Amu Darya and Syr Darya, two main rivers of Central Asia, flow. These rivers play a vital role in the agricultural development of the rest of the region, supplying water to vast drylands. Investment loans for the development of water supply systems can play a positive role in the development of local agriculture and strengthening food security.

Table: GDP of Central Asian countries according to the World Bank ($ billion), 2010-2022.

|

Year

|

Kazakhstan

|

Uzbekistan

|

Turkmenistan

|

Kyrgyzstan

|

Tajikistan

|

|

2010

|

148,05

|

49,37

|

22,58

|

4,79

|

5,64

|

|

2011

|

192,63

|

60,18

|

29,23

|

6,20

|

6,52

|

|

2012

|

208,00

|

67,52

|

35,16

|

6,61

|

7,63

|

|

2013

|

236,63

|

73,18

|

39,20

|

7,34

|

8,45

|

|

2014

|

221,42

|

80,85

|

43,52

|

7,47

|

9,11

|

|

2015

|

184,39

|

86,20

|

35,80

|

6,68

|

8,27

|

|

2016

|

137,28

|

86,14

|

36,17

|

6,81

|

6,99

|

|

2017

|

166,81

|

62,08

|

37,93

|

7,70

|

7,54

|

|

2018

|

179,34

|

52,87

|

40,77

|

8,27

|

7,77

|

|

2019

|

181,67

|

60,28

|

44,22

|

8,87

|

8,30

|

|

2020

|

171,08

|

60,22

|

45,61

|

7,78

|

8,13

|

|

2021

|

197,11

|

69,60

|

-

|

8,74

|

8,94

|

|

2022

|

220,62

|

80,39

|

-

|

10,93

|

10,49

|

To a large extent, the investment attractiveness of Central Asia is determined by large reserves of non-ferrous and rare earth metals, such as copper, aluminum, silver, tungsten, etc.

Gold mining is actively carried out in Uzbekistan, Kyrgyzstan and Kazakhstan. Uranium reserves are also of great interest to foreign companies. Although there are no operating nuclear power plants in the region, Uzbekistan and Kazakhstan have traditionally been of significant economic and geopolitical importance as suppliers of uranium fuel.

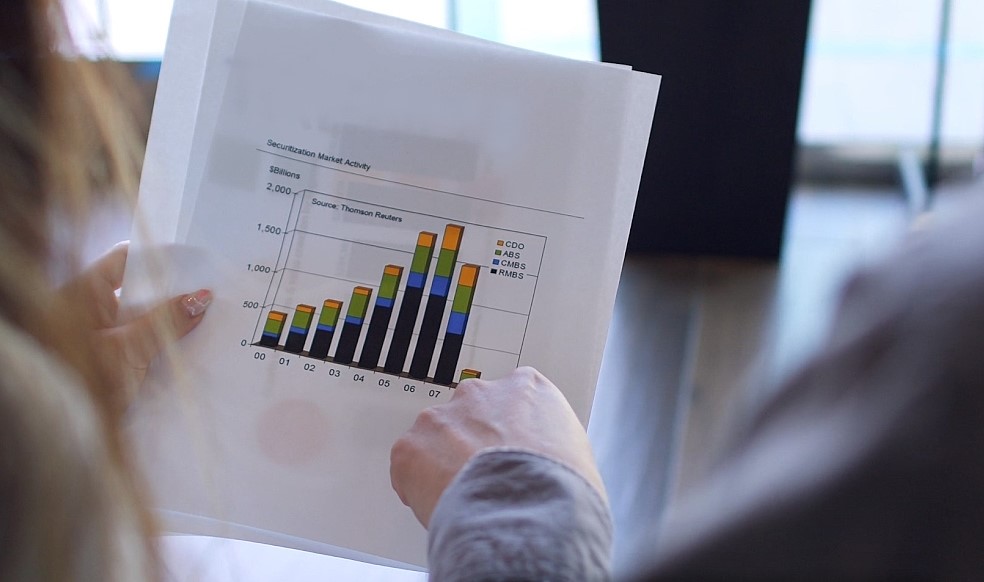

Significant investment loans and other forms of foreign capital participation have been noted in such industries as the production and transportation of oil and gas, petrochemical industry, ferrous metallurgy, copper production, the automotive industry, electronics production, and so on.

Since independence, the economic structure of the region has undergone significant changes. In particular, many high-tech industries were reduced or completely lost (for example, the aircraft manufacturing industry in Uzbekistan). On the other hand, the countries of the region were able to develop a large number of new industrial projects with the participation of foreign companies, including Ispat (metallurgy), Samsung (various industries), Access Industries (natural resources) and many others.

Major investments in the local automotive industry have been made by world famous brands such as MAN, General Motors, Ford, KIA, SsangYong and Isuzu.

The investment attractiveness of Central Asia is often viewed from the perspective of its enormous oil, gas and mineral potential.

However, the region does not have direct access to the ocean and sea communications, so these countries have transit dependence on bordering states to export their resources. This raises the issue of investing in international infrastructure projects, such as oil and gas pipelines laid through the territories of the South Caucasus towards European consumers.

In recent decades, the development of pipelines has proceeded in parallel with the development of Caspian oil and gas fields.

The driving force behind this movement was the active activities of the United States and the EU, which are interested in diversifying oil and gas supply routes. The role of China and India is also growing, as they seek to provide economies with affordable fuel.

Many investment loans in the Central Asian republics are related to logistics projects and transport. In particular, the Chinese New Silk Road project is actively developing and is a direct competitor to the Russian Trans-Siberian Railway. The development of alternative transport routes will continue in the coming years, which means the transit potential of the region will strengthen.

Since 2022, when the situation in Ukraine caused a deep split between the countries of the global West and Russia with its closest allies, the geopolitical and economic role of Central Asia in the world has increased even more. Enormous natural resources, a unique geographical position, and a well-balanced policy give the economies of the region unique opportunities and benefits. Rapid GDP growth and increased foreign investment over the past year confirm the new reality.

General information about investment lending in Central Asia

A wide range of sources of long-term investment financing and lending for large projects are now available in the countries of the region. International organizations such as the Asian Development Bank (ADB), the World Bank and the European Bank for Reconstruction and Development (EBRD) provide financing and support for various projects in the region.Examples could be financing infrastructure projects, improving education and healthcare, and supporting the development of small and medium-sized businesses.

Investment funds such as those of the European Investment Bank (EIB) are also active in financing infrastructure and development projects in the region. Many projects in Central Asia are financed through multilateral agreements between countries and international institutions. An example would be the construction of railways or highways, which could be financed by several countries.

There are both local and international banks in the Central Asia region, providing loans and financial support to large business projects. Examples of local banks include Kazkommertsbank and Halyk Bank in Kazakhstan, National Bank of Uzbekistan in Uzbekistan and others.

Local banks and government institutions play an important role in financing strategically important projects.

These may also be large specialized financial organizations, such as Samruk-Kazyna Joint Stock Company in Kazakhstan. The latter is an investment holding company whose mission is to improve the national welfare of Kazakhstan and ensure long-term sustainability for future generations.

Below are general facts about investment lending in Central Asian countries:

• Growth of investment flows. Central Asian countries such as Kazakhstan, Uzbekistan and Turkmenistan have become attractive to foreign investors due to their natural resources, geographical location and the authorities' desire to integrate into the global economy.

• Foreign investment. According to World Bank reports, recent years have seen an increase in foreign investment in the region. Kazakhstan and Uzbekistan are one of the largest recipients of foreign direct investment (FDI) among Central Asian countries.

• Development of financial markets. Many Central Asian countries are working to develop local financial markets and banking systems to support large investment projects. For example, Kazakhstan is actively developing its stock market.

• Regional projects. The countries of Central Asia are actively involved in financing regional infrastructure projects, such as the construction of transport routes, gas pipelines and energy highways. These projects can provide significant opportunities for investors.

• The importance of agriculture and resources. Agriculture and mining remain key sectors for investment in the region, as it has vast natural resources.

• Risks and challenges. Despite the high growth potential, investors also face a number of risks, including political instability, low transparency and complex tax regulations.

• Cooperation with international organizations. Central Asian countries are actively cooperating with international organizations such as the Asian Development Bank and the International Monetary Fund to attract investment and reform the economy.

The governments, local businesses and their international partners are also financing many mining investment projects related to the extraction / export of natural resources such as oil, gas, uranium and rare metals.

In this context, a special role is given to project finance instruments and investment loans. Several countries in the region provide effective national programs and incentives to encourage investment in key sectors such as energy, transport and agriculture.

Large companies seeking to attract investment loans or other types of financing in Kazakhstan, Uzbekistan, Turkmenistan, Tajikistan or Kyrgyzstan may require a variety of services and resources to successfully implement their investment projects.

In particular, such companies can use the following services:

1. Financial consulting. Companies can contact our financial consultants and analysts to develop the optimal strategy, analyze risks and select suitable financial instruments.

2. Legal services. Legal advice and services may be required to prepare legal documents, agreements and contracts with lenders, and to ensure compliance with local laws.

3. Project evaluation. To attract funds, companies can order a professional assessment of their investment project, which will help potential investors understand its value and prospects.

4. Banking services. To obtain a loan or other form of company financing, we can offer contacts with local financial institutions and international banks, which may include processing loan applications and discussing financial terms.

5. Risk insurance. Companies may also be interested in insuring the risks associated with investment projects to provide protection against potential losses.

6. Audit and control of financial flows. Audit and control services provided by experts will help ensure transparency and effective project management.

7. Contacts with government agencies. Cooperation with local and national authorities may be required to obtain necessary permits and support for the project. Specialists in Astana, Tashkent, Ashgabat, Dushanbe and Bishkek will help make the development process of your investment project smoother and faster.

8. Project management support. Managing and monitoring an investment project may require specialized services to track its successful implementation at all stages.

Project financing in Central Asia requires an integrated approach and collaboration with various specialists and organizations to ensure the efficient and safe execution of investment plans.

If you are looking for a reliable partner who is ready to offer a full range of services for modeling, financing and managing an investment project in the region, you can always contact us.