After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

- An overview of India's electricity sector

- A brief overview of Indian wind energy sector

- Financing the construction of wind farms in India

- Wind power equipment manufacturers and suppliers

- Integration of renewable energy sources into the Indian power grid

- Construction of wind farms in India under the EPC contract: advantages for the investor

The Indian wind energy sector is the fourth in the world in terms of installed capacity and the fifth in terms of installed capacity growth.

The construction of wind farms in India is of great interest to local companies and foreign investors.

Between 2016 and 2019, foreign direct investment in renewables increased from $ 783 million to almost $ 1.44 billion.

Over the past decade, FDI inflows to the renewable energy sector in India have exceeded $ 8.8 billion and are growing.

It is expected that the total installed capacity of wind farms in India by the end of 2020 will reach almost 50 GW. This is somewhat lower than the stated goals, but the achieved result is consistent with the leading role of India in the world wind energy.

Moving away from fossil fuel is becoming a real goal thanks to the development of domestic production of wind turbines and auxiliary equipment.

Today it is quite a mature industry that is able to thrive without the government incentives that have protected Indian wind energy sector over the past decades.

Annual economic growth of 6-7% makes India one of the fastest growing economies in the world.

Accelerated structural reforms, low prices for equipment and materials, recent market deregulation measures and efforts to simplify business have boosted growth and attracted foreign investment in the country.

India is the second most attractive destination for renewable energy investments, according to a 2017 report by Ernst & Young.

Wind power sector also creates a large number of highly skilled jobs, which will reach 180,000 by 2022.

Most of India's energy projects are being developed by large independent energy producers (IPPs). The most important among these are local companies that have agreements with foreign financial agencies and are capable of adding over 100 MW of installed capacity annually.

Typically, the engineering design and construction of wind farms in India is carried out under an EPC contract.

The overwhelming majority of customers expect complete turnkey projects from engineering firms.

If you need project financing and construction of a wind farm, please contact our consultants at any time.

An overview of India's electricity sector

To better understand the potential for wind investment, it is necessary to first analyze the current structure, problems and perspectives of India's electricity sector.India is growing at a very fast pace and cheap energy is one of the keys to sustaining this growth. Providing electricity to the population of remote regions and effectively supporting the development of industry and infrastructure of the country are the priority tasks of the government.

Since 2000, India has more than halved the number of people without access to the grid, and has also been able to double the rate of rural electrification.

Back in 2015, 144 million people (12% of the country's population) did not have access to the electricity grid.

The government is investing huge amounts of money in electrification, aiming for the power grid to reach the most remote areas of the country as early as 2022.

Despite the fact that power generation capacity has grown significantly in recent years, India still faces severe power shortages. Periodic blackouts are observed in almost all industrial centers.

One problem is that the final electricity prices in most states are set below the real costs of its production, transmission and distribution. Subsidization is widespread in India at all levels. For example, several states provide electricity to farmers for free.

The current situation significantly reduces the competitiveness of local companies and creates a barrier to investment in the construction of wind farms in India. In recent years, the poor financial health of state-owned distribution companies (DISCOMs) has created uncertainty among potential investors about generating electricity, exacerbating the imbalance in the grid.

Energy policy in India is highly decentralized.

There is no single body that has complete control over the national energy policy.

Instead, several ministries share power over different aspects of energy policy and local infrastructure development.

The country's electricity sector is a joint responsibility of the states and central government. Energy produced and sold in the same state is controlled by the local body responsible for the generation, transmission and distribution of energy by and the State Electricity Regulatory Commission, SERC (the body responsible for electricity regulation and tariff setting).

At the same time, electricity sold between states is subject to centralized supervision and regulation. This separation of decision-making powers, which is beneficial in some situations, causes unnecessary duplication of control functions and complicates decision-making.

Development of renewable energy sources

India's energy production relies heavily on fossil fuels (coal, oil and natural gas).Since the country has to import a significant portion of these fossil fuels, this increases the trade deficit. In terms of electricity production, it should be noted the dependence on coal, which accounted for almost ¾ of the electricity consumed in 2018.

The development of renewable energy sources in India is critical to economic growth.

A special ministry has been created in the country dedicated to this direction - MNRE, the Ministry of New and Renewable Energy. The MNRE is responsible for the development and implementation of all policies for the use of new energy sources.

Since coming to power in 2014, the government of Narendra Modi has taken a number of measures to develop renewable energy sector. In the coming years, this sector should meet growing domestic demand for electricity, providing the country with greater energy independence and reducing its geo-economic vulnerability.

The government's Make in India program identifies the promotion of renewable energy as one of the fundamental pillars of economic growth, establishing the regulatory, economic and policy framework for the development of this sector in the country. This move puts industry at the center of India's growth model and implies a significant increase in energy demand.

The installed capacity of renewable energy sources in the country exceeded 74 GW as of April 1, 2019.

The renewable energy market has grown fivefold over the past 10 years, starting at 14.4 GW at the beginning of 2009.

With one of the largest and most ambitious renewable energy programs in the world, India can truly play a leading role in the global energy transformation.

The country has set the goal of reaching 175 GW of installed renewable energy capacity by 2022.

Research shows that the potential for renewable energy growth is huge, and therefore these highly ambitious goals are potentially achievable.

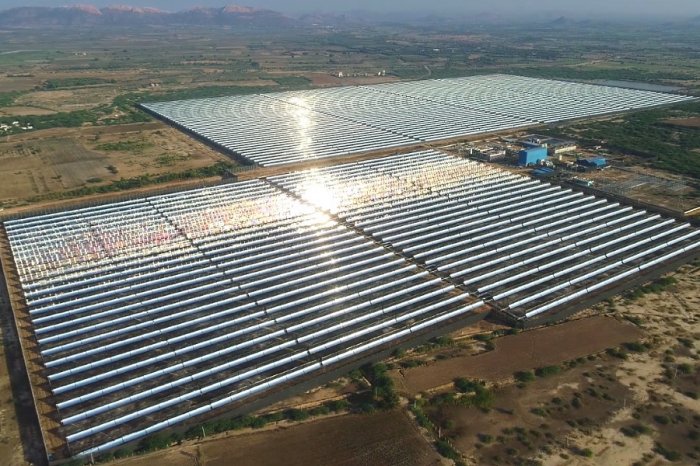

The active construction of wind farms in India, along with the implementation of the largest solar projects, contributes to their achievement.

The table below contains the structure of the Indian energy sector at the end of 2017:

| Energy source | Annual output, GWh | Percent, % |

| Coal | 944850 | 76,44 |

| Hydropower | 122313 | 9,90 |

| Renewable sources | 81869 | 6,62 |

| Natural gas | 49100 | 3,97 |

| Nuclear power | 37663 | 3,05 |

| Diesel | 262 | 0,02 |

India's energy policy aims to achieve a total installed capacity of 800 GW in 2031-2032.

About 40% (320 GW) will be provided by renewable energy sources in accordance with government plans.

Electricity demand in the country

Electricity consumption per capita in India has grown steadily over the past decade at about 6-7% per year, largely due to significant achievements in rural electrification.Despite all the successes achieved, consumption is very low compared to the rest of the world. Per capita electricity consumption in India is the lowest among the BRICS countries and barely reaches 1/3 of the global average.

However, consumption patterns differ between states.

The highest per capita consumption is found in the states of Puducherry, Goa, Punjab, Gujarat, Haryana and Delhi, remaining above the national average. On the other hand, the northeastern states and the state of Bihar show the worst results.

The current government focuses on domestic national production (Make in India), which stimulates the growth of the industry. This approach, in addition to obtaining economic benefits, also tends to increase the energy intensity of the economy.

This makes energy efficiency increasingly important.

According to the forecast of McKinsey & Company, electricity demand in India will grow by about 5.9-6.6% per year, reaching 1604-1668 kWh by 2021-22 fiscal year.

Demand from the population is expected to grow rapidly (CAGR 8.2%) and industrial demand to increase by about 4-5.5%. Urbanization will play an important role in increasing demand: the population of Indian cities will increase from 435 million in 2015 to 600 million in 2030.

The International Renewable Energy Agency (IRENA) predicts that by 2030, India's total energy demand will double and electricity demand will triple.

Wind energy tariffs go down

In recent years, electricity tariffs in India have decreased to less than 2.5 rupees per kWh. At one point, this disadvantaged many wind power companies and slowed the sector down.The first auctions in the wind energy sector were conducted through the Solar Energy Corporation of India (SECI) in February 2017 under the control of the central government. The very first 1 GWh of energy was sold at 3.46 rupees ($ 0.054) per kWh. This represented a 20% reduction in tariff compared to the figures that existed in this sector under the feed-in-tariff regimen.

The auctions hit hard on the old feed-in tariff model for wind power, in which prices were set by the regulators of each state. After this first auction, states began to refuse to sign new Power Purchase Agreements (PPAs) due to the price difference.

During the ensuing period of uncertainty, there were negative consequences such as financial weakness of OEMs, the threat of a revision of existing PPAs and a drop in investor confidence.

These problems add to the existing ones, including the status of DISCOMs, bureaucratization of land purchase procedures, and the technical complexity of integrating renewables into the Indian power grid. Today, the construction of new wind farms in India requires a cautious approach, including thorough market research.

A brief overview of Indian wind energy sector

Wind power in India is a mature industry with nearly thirty years of history.It currently ranks fourth in the word in terms of installed capacity, behind China, the United States and Germany. In the first half of 2019, the country's installed wind farm capacity exceeded 35 GW, with approximately 90% of investments coming from the private sector.

The Indian wind energy sector has developed a strong supply chain based on cutting-edge technologies that can take advantage of the potential benefits of foreign factories in the country.

Wind resource assessment

India's wind resources are determined by the strong southwest summer monsoon, which begins in May-June, and the weak northeast monsoon, which usually begins in October.Only western states with high wind speeds are of interest to investors.

The Center for Wind Energy Technology (C-WET) analyzes and reports all wind data based on meteorological observations. The atlases compiled from this information are used to determine the locations with the most suitable conditions for new wind farms.

In India, the vast majority of winds are weak (IEC III).

This fact implies the need to adapt the blades of wind turbines to make them lighter and longer. Winds classified as IEC I do not occur in India, whereas IEC II winds are found primarily in Tamil Nadu and Karnataka.

The National Institute of Wind Energy (NIWE) is responsible for conducting research on the wind resources. These studies are essential for the engineering design and construction of wind farms in India, including identifying the most suitable locations for project development.

The 2015 Indian Wind Atlas states India's wind potential is 302 GW at 100 meters.

By states, the first place belongs to Gujarat with 84.4 GW, followed by Karnataka (55.85 GW), Maharashtra (45.39 GW), Andhra Pradesh (44.22 GW), Tamil Nadu (33.79 GW), Rajasthan (18.77 GW) and Madhya Pradesh (10.48 GW).

On the other hand, India has colossal untapped offshore wind resources. The National Offshore Wind Policy, announced in 2015, was developed through the Facilitating Offshore Wind in India (FOWIND) project to use 7,600 km of coastline.

The FOWIND project, presented in June 2018 with EU co-financing, is the first study of the feasibility of building offshore wind farms on the Tamil Nadu and Gujarat coastlines, with an installed capacity of at least 5 GW by 2032.

The need for modernization of wind farms

Experts point to a special segment of the emerging market that deserves the attention of investors.It is a wind farm modernization in India, which consists of replacing old low power turbines or faulty turbines with newer ones at existing wind farms across the country.

India has significant growth potential in this regard, as a large number of wind farms were installed more than 10 years ago, when the industry began to grow due to the attractiveness of the accelerated depreciation system (80% of the project in the first year).

Under the new policy, many of India's wind farms will be undergoing modernization in the coming years, opening up great business opportunities.

Wind energy market size in 2018-2019

Over the past few years, the installed capacity of wind farms in India has shown relatively constant growth.As of the beginning of 2019, the top three states were Tamil Nadu, Gujarat and Maharashtra, which account for more than 55% of the total installed capacity.

Below are the top-7 wind power states (december 2018):

| State | Installed capacity, MW |

| Tamil Nadu | 8630 |

| Gujarat | 6040 |

| Maharashtra | 4790 |

| Karnataka | 4580 |

| Rajasthan | 4300 |

| Andhra Pradesh | 4076 |

| Madhya Pradesh | 2520 |

Wind continues to be one of the dominant sources in the Indian renewable energy sector, accounting for about 50% of the installed renewable energy capacity and 10% of the total installed capacity.

The central government, state governments and the private sector are now driving demand for wind projects in India.

Over the past few years, state governments have absorbed most of this demand. The development of wind farms is carried out through direct incentives after individual negotiations between the states, wind power plant developers and wind turbine manufacturers.

Financing the construction of wind farms in India

The government's goal to increase the installed capacity of renewable energy sources to 175 GW requires investments of about $ 170-190 billion.This calls for particular attention to financing the construction of wind farms in India.

From a technical point of view, wind farms are significantly different from traditional energy sources. The cost structure for building and operating wind farms is also different. These are capital intensive projects with zero fuel costs.

They require a significant initial investment, but the cost of electricity is independent of the price of fossil fuels, resulting in a more predictable operation.

Unlike thermal power plants or nuclear power plants, wind farms in India are primarily driven by the private sector. Despite the obvious prospects for the sector, it is still a challenge for private companies to attract significant amounts of financing on optimal terms.

Financing wind projects in India will require more active government cooperation with banks and financial institutions.

So far, local banks are more active in financing conventional energy projects than renewables, which are characterized by greater uncertainty and financial risks.

This is reflected in the fact that bank loans for renewable energy projects in India remain more expensive than in Europe.

Despite this, about 70% of funds for the construction of wind farms come from banks, and institutional investors and private equity firms provide a small part of these funds.

Renewable energy financing is currently offered by IDFC, L&T Finance Holdings, PTC India Financial Services, IndusInd Bank, DBS Bank, Power Finance Corp, International Finance Corp, Yes Bank, India Infradebt, Union Bank of India, as well as Asian Development Bank and others.

Our company offers financing for the construction of wind farms, including soft loans from leading European banks.

To find out more about project finance, please contact our representatives.

Wind power equipment manufacturers and suppliers

In 2019, the world's top 10 onshore wind turbine manufacturers, excluding Chinese Goldwind and Guodian, were either present in the Indian market or were in the process of entering the market.Only six original equipment manufacturers (OEMs) exceeded the 100 MW barrier in the 2016/17 fiscal year, and together they accumulated 98% of total capacity over the period.

In terms of total installed capacity in the country, the top five largest manufacturers were Suzlon (35.4%), WindWorld (18%), Gamesa (10.1%), Vestas (7.6%), Regen (7.3%) and Inox (5.68%).

WindWorld has lost ground in recent years, and the strengthening of GE and Vestas, along with the arrival of Nordex and Senvion, have significantly changed the local competitive landscape.

Currently, the main wind turbine manufacturers in India are:

| Manufacturer | Market entry year | Official center |

| Suzlon One Earth | 1995 | Pune, Maharashtra |

| Inox Wind | 2006 | Noida, Uttar Pradesh |

| Vestas India | 1989 | Chennai, Tamil Nadu |

| ReGen Powertech | 1994 | Chennai, Tamil Nadu |

| Siemens-Gamesa | 2009 | Chennai, Tamil Nadu |

| GE India Industrial | 2011 | Bangalore, Karnataka |

| Acciona Windpower India | 2015 | Bangalore, Karnataka |

| Senvion India | 2016 | Mumbai, Maharashtra |

The dominance of overseas companies in the Indian market has increased over the past few years.

This trend continues with the growth of new players such as General Electric, Envision and Nordex-Acciona.

To operate in India, OEMs must submit certificates obtained from accreditation agencies to the online RLMM registry.

In India, the import of finished wind turbines is prohibited, so all manufacturers who compete in the market have their assembly plants in the country and create jobs for the local population. In terms of exports, Indian factories export equipment for wind farms to countries such as France, USA, Italy, Great Britain, Austria, Iran, Turkey and Sri Lanka.

Foreign companies are truly capable of turning India into a world leader in wind turbine exports. The world's largest manufacturers are now increasing their production, stepping up the export of equipment from South Asia.

According to Ben Backwell, CEO of Global Wіnd Sounсіl, India is the ideal country to establish a wind energy manufacturing hub that could become a part of the global supply chain. The production cost of equipment is low here. In addition, the country has a strong engineering sector.

The active construction of new wind farms in India requires an increase in the production of wind turbines and auxiliary equipment. This is facilitated by the need for modernization of wind farms, which faces many companies.

Integration of renewable energy sources into the Indian power grid

Despite progress in capacity expansion, a large proportion of India's population lacks access to clean and cheap electricity.The country's transmission and distribution network poorly covers rural or remote areas.

The sector faces several major challenges.

First, the development of local energy requires overcoming administrative obstacles and delays in obtaining permits.

Secondly, demand and supply for electricity is unevenly distributed throughout the country, which requires new construction of new transmission lines between states.

Third, over 60% of India's existing capacity are coal-fired power plants with little ability to respond to fluctuations in demand and production.

The technical and economic challenges of integrating renewable energy sources in India are slowing wind energy growth and jeopardizing government plans.

The peak wind season in some of the main “wind states” (Gujarat and Tamil Nadu) lasts from May to August, and consumption peaks in October when the wind resource is low. As a consequence, wind energy accounts for up to 35% of total electricity consumption during the peak wind season, but only 5% during the high-demand season.

In terms of renewables in general, plans to expand electrical substations and transmission lines in India are not always in the best interest of the sector, leading to bottlenecks in the grid.

Another important problem is the lack of a uniform approach to infrastructure expansion across states. The practice of connecting renewable energy projects implemented by public utilities is very different from each other, which is a serious risk for investors. Delays in the construction of wind farms in India are often the result of inconsistencies and excessive bureaucracy in the sector.

To solve the problems associated with the integration of renewables, the government through the Power Grid Corporation of India Limited (PGCIL) launched the Green Energy Corridor program. The goal of the program is to optimize the integration between local grids, to facilitate the transfer of energy from states with high installed renewable capacity to other regions.

To facilitate the transfer of wind power, a recent change in tariff policy calls for exemption from interstate transmission charges.

This exemption will apply for 25 years for projects commissioned before March 31, 2019.

The development of hybrid renewable energy solutions (wind and solar) will enable better use of infrastructure and address the problem of production variability. A new hybrid wind-solar project, published in June 2016, is expected to boost the number of combined solar-wind parks across the country.

Cryogenic energy storage (CES) for wind energy sector

Uneven wind energy production requires the implementation of cost-effective energy storage technologies.As a result of frequent fluctuations in generation, the grid can only use a small amount of electricity.

Maintaining a balance of various elements of the electrical system, such as generation, transmission and control, is essential for the widespread penetration of renewable energy sources.

Highview Power cryogenic systems are by far the most cost-effective and compact technical solution that offers a viable alternative to traditional pumped storage power plants.

These storages provides uninterrupted power supply to consumers for several weeks, using previously accumulated renewable energy.

They can be built almost anywhere without being demanding of elevation differences and terrain.

Such facilities are ideal for areas with underdeveloped infrastructure, so CES could radically change the current situation in the Indian wind energy sector.

Cryogenic energy storage technology was implemented by the British company Highview Power in the construction of the first ever liquid air energy storage (LAES) in Bury, Manchester. This project demonstrated to investors the clear advantages of CES over alternative technologies.

The company has already completed more than 10 energy storage projects in the past.

Construction of wind farms in India under the EPC contract: advantages for the investor

The volume of investment for projects in wind power, and hence the efficiency of spending money, directly depend on the chosen formula for project implementation.EPC (Engineering, Procurement and Construction), widely used in India, is more expensive, but this formula eliminates any risks.

An EPC contract is suitable for large investment projects (for example, construction of wind farms, modernization of transmission and distribution lines), where the investor does not participate in the development of project documentation, but only provides financing.

According to the EPC contract, the single company contracting with the investor is fully responsible for the implementation of the project, including the engineering design, manufacture, delivery and installation of electrical and mechanical equipment, as well as construction and installation work.

The contractor provides the customer with a completed facility, ready for operation.

The EPC contractor guarantees the investor that the final price of the contract will be respected.

He also monitors compliance with the schedule, as well as technical conditions.

However, the consequence of such arrangements is a higher pay for the contractor, who bears most of the risk, and therefore higher overall capital costs. In the case of wind farm construction in India, where investors face a lot of risks and uncertainties, such a formula is considered the most justified. When it comes to attracting external financing, the implementation of energy projects is usually carried out under an EPC contract.

In the case of signing an EPC contract, the investor has very limited participation in the implementation of the energy project.

An experienced contractor independently selects equipment, materials and technologies in such a way that in the end the result of the contract fully meets the customer's requirements.

Consequently, the investor's requirements describe the investment project in general terms — and the main emphasis here is on the economic, functional and technical requirements for the object.

Advantages of the construction of wind farms under the EPC contract:

• Concentration of responsibility on a single contractor.

• Minimizing the risk associated with incorrect or incomplete documentation.

• Minimal customer intervention in the tendering processes, and so on.

• Reducing risk by providing a fixed contract price.

A higher contract price is generally considered justified due to the stability of the contract price and the contractor's compliance with the schedule.

The correct contract formulation, especially in the context of risk sharing and the use of standard bidding solutions, can provide some reduction in project cost. Effective technical dialogue between investor and contractor contributes to achieving this goal.

How much does it cost to build a wind farm

The cost of wind farms in India is generally lower than in Western Europe or the United States.This is due to the availability of cheaper workers and competitive prices for locally produced equipment.

The main component of construction costs is a wind generator. This equipment accounts for over 70% of the total investment. Other components are electrical connections, land acquisition and conversion costs, wind tests, construction work and technical documentation.

Despite all the difficulties, wind energy remains a profitable and promising business. Based on our experience, the construction of wind farms in regions with above average wind speeds usually pays off quickly.

GCAM Investment Group offers wind farm financing and construction services in India under an EPC contract.