After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

Borrowed capital is attracted to finance both the main economic activity and to increase the investment potential of the company.

Classification of borrowed capital raised by enterprises

Borrowed capital is classified into long-term and short-term.Long-term obligations are debts that arise when capital is borrowed for a period of more than 1 year.

These liabilities are listed below:

• Debts for issued bonds.

• Debts under the tax credit.

• Debts for long-term loans from banks and non-banking institutions.

• Debts due to financial assistance provided on the terms of refund.

• Debts under financial lease agreements, etc.

Short-term financial obligations arise when borrowing capital for up to 1 year.

These include the following obligations:

• Debts for advances received.

• Debts for goods, works and services.

• Debts on issued promissory notes.

• Debts for short-term loans from banks and non-banking institutions.

• Debts due to settlements with the budget and non-budgetary funds.

• Debts arising from settlements with subsidiaries.

• Salaries payable, etc.

Table: Structure of borrowed capital

| Long-term financial obligations | Short-term financial obligations |

| Long-term bank loans | Short-term bank loans |

| Long-term loans from other institutions | Short-term loans from other institutions |

| Instruments of financial leasing | Accounts payable for goods and services |

| Bonds issued by the company | Accounts payable to the budget |

| Other funds are provided on the terms of return | Salaries payable |

Sources and forms of attracting borrowed capital by large companies are extremely diverse.

These can be various instruments, both secured and unsecured. Borrowed capital can be classified by the characteristics listed in the table below.

Table: Classification of the borrowed capital.

| Criteria | Description |

| Capital raising goals | to replenish current assets |

| to ensure the reproduction of fixed assets | |

| to meet other economic or social needs | |

| Sources of capital | external sources |

| internal sources | |

| The period of use | long-term capital |

| short-term capital | |

| Capital form | in monetary form (bank loan) |

| in the form of equipment (financial leasing) | |

| in the form of goods (commodity loans) | |

| in other tangible or intangible forms | |

| Securing the debt | unsecured debt |

| debt secured by a deposit or collateral | |

| debt secured by a guarantee or surety |

Taking into account the classification of debt funds, various methods of capital management are used.

Despite its seeming simplicity, this question is one of the most important in organizing the financing of a large business and is one of the first to be solved.

Stages of borrowed capital management

Management of borrowing funds is a purposeful process of their formation from various sources and in various forms in accordance with the needs of the business and the implementation of its investment projects at various stages of development.The process of managing the attraction of borrowed capital is carried out according to the following main stages:

Stage 1. Analysis of the borrowed capital in the previous period. The purpose of such an analysis is to identify the volume, structure and forms of attracting loan funds by the enterprise, as well as to assess the effectiveness of their use. The results of the analysis serve as the basis for assessing the expediency of using loan funds in the volumes and forms that are already available.

Stage 2. Determination of the goals of attracting loan funds in the future period. The company attracts these funds to achieve clearly defined goals, which is one of the prerequisites for their further effective use.

The main goals of attracting borrowed capital by large enterprises are:

• Replenishment of minimum required current assets.

• Ensuring the formation of a variable part of current assets. Whatever model of asset financing the company uses, in all cases the variable part of current assets is partially or fully financed by borrowed funds.

• Formation of long-term resources to ensure investment activities.

• Ensuring the social needs of employees. In these cases, borrowed capital can be used to issue loans to its employees for housing construction, health improvement and so on.

• Other capital needs, which are usually financed for short terms.

Stage 3. Determination of the maximum amount of borrowing capital dictated by two main factors:

• Maximum financial leverage. Since the amount of internal financial resources is formed at the previous stage, the amount of equity capital can be determined in advance. In accordance with it, the coefficient of financial leverage is calculated, at which the project's effectiveness will be the greatest.

• Ensuring sufficient financial stability of the business. Taking into account these requirements, the enterprise sets a limit for the use of loan funds in its activity.

Stage 4. Estimating the cost of raising borrowed capital from various sources. The results of such an assessment serve as the basis for the development of further management decisions regarding the selection of alternative sources of business financing.

Stage 5. Determination of the ratio of loan funds, which are attracted on a short- and long-term basis. For a long-term period (more than 1 year), loan funds are usually used to increase fixed assets and form the necessary investment resources. For the short term, loan funds are used for all other purposes. The calculation of the necessary borrowed capital within each period is carried out in terms of certain areas of its future use.

Stage 6. Determination of forms of attracting borrowed capital. These forms are usually differentiated into traditional financial loans, commodity loans and other instruments.

Stage 7. Determination of the main sources of funding. This circle is determined by the forms of attracting borrowed capital. The main creditors of a commercial enterprise are usually its suppliers, with whom long-term commercial relations have been established, as well as a commercial bank that provides its settlement and cash service.

Stage 8. Ensuring optimal conditions for attracting loans. The most important of these conditions include the loan repayment period, the interest rate, the specifics of tax payment, the conditions for paying the main part of the debt, as well as legal and contractual limitations.

Stage 9. Ensuring efficient use of borrowed capital. Indicators of turnover and return of capital are considered as criteria of such efficiency.

Stage 10. Ensuring timely payments for received loans. For this, a special fund can be formed in advance for large loans. Loan servicing payments are included in the payment calendar and are controlled during the monitoring of current financial activity.

Obtaining bank loans for large businesses

A bank loan is money that the bank lends to the client for a specified period of time at a certain interest rate.Bank loan management is carried out according to the following main stages:

1. Determination of the purposes of using a loan.

2. Assessment of the creditworthiness of the enterprise.

3. Choosing the necessary types of bank loan.

4. Study and assessment of bank lending conditions in terms of loan types.

5. Approval of financing terms in the process of concluding a loan agreement.

6. Ensuring efficient use of borrowed capital.

7. Organization of continuous control over the debt service.

8. Ensuring timely and full amortization of the principal amount.

During the assessment of loan conditions in terms of types of loans, a special indicator called "grant element" is used.

This indicator allows the financial team to compare the cost of a loan from several banks with the average conditions in the financial market (depending on the length of the loan period).

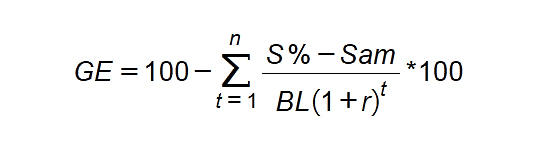

The calculation of this indicator is carried out according to the following formula:

GE is grant element that characterizes the deviations of the value of a specific financial loan on the terms proposed by bank from the average market value of similar credit instruments.

S% is the amount of interest paid in a specific interval (t) of the credit period.

Sam is the amount of principal debt amortization in specific interval (t) of the credit period.

BL is the total amount of the bank loan received by the enterprise.

r is the average interest rate for a loan that has developed on the market for similar tools.

t is a specific interval of the credit period in which the loan payment is made.

n is the duration of the credit period, expressed by the number of intervals included in it.

Since the grant element compares the deviation of the cost of attracting a specific loan from the market average (expressed as a percentage of the loan amount), its value can be both positive and negative.

By ranking the value of the grant element, it is possible to assess the level of effectiveness of attracting a bank loan in accordance with the proposals of another banks. "Equalization" of loan conditions in the process of concluding a loan agreement is carried out on the basis of the grant element and the effective interest rate on the credit market.

The criteria for effective use of a bank loan are the following conditions:

• The interest rate for a short-term bank loan must be lower than the profitability of business operations for which borrowed capital is used.

• The interest rate on a long-term bank loan must be lower than the rate of return on assets, otherwise the effect of financial leverage will have a negative value.

Financial leasing management

Financial leasing is an operation consisting in the purchase of fixed assets by the lessor with subsequent transfer to the lessee for a period not exceeding the period of their full depreciation, with subsequent transfer of ownership of these fixed assets to the lessee.Financial leasing (FL) is one of the types of financial credit. Fixed assets transferred under financial leasing are included in the lessee's fixed assets.

Credit aspects of financial leasing are listed below:

• FL satisfies the business need for the most scarce form of capital, long-term.

• FL provides full satisfaction of a specific business need for loan resources.

• FL automatically forms loan collateral, which reduces the cost of capital.

• Financial leasing provides a "tax shield" for the entire amount of capital involved. Leasing payments, which provide amortization of the entire amount of the principal debt, are part of the company's expenses and reduce the taxation of its profit accordingly. For a bank loan, a similar "tax shield" applies only to loan servicing payments, and not to the principal debt. In addition, a certain system of tax benefits may also apply to the lessor.

• Financial leasing provides a wider range of forms of payments related to debt service. It provides for the possibility of making payments, for example, in the form of supplies of goods produced using leased assets.

• FL provides flexibility in terms of payments related to debt service.

• FL is characterized by a simpler procedure compared to traditional bank loan.

• Financial leasing does not require the company to set aside resources to repay the principal debt, which is explained by its gradual amortization.

The listed credit aspects of financial leasing determine it as a rather attractive credit instrument in the process of attracting borrowed capital by the enterprise to ensure its economic development.

Types of financial leasing

FL is classified according to many criteria listed in the table below.Understanding the advantages and disadvantages of each type of leasing helps to make optimal decisions when searching for and attracting financial resources for various projects.

Table: Classification of financial leasing.

| Criteria | Description |

| Structure of operation | Direct leasing means a leasing operation carried out between the lessor and the lessee without intermediaries. |

| Indirect leasing refers to the transfer of property to the lessee through one or more intermediaries, usually at a higher cost. | |

| Host country | Internal leasing means that all participants in the operation are residents of the same country. |

| External, also known as international financial leasing, is carried out by participants from different countries | |

| Objects of leasing | Leasing of immovable property. |

| Leasing of movable property and assets. | |

| Forms of leasing payments | Monetary leasing. Payments under the leasing agreement are made exclusively in monetary form. |

| Compensatory leasing. It provides for the possibility of making leasing payments in the form of product supplies (goods, services). | |

| Mixed leasing combines payments under the leasing agreement in both monetary and commodity form or in form of counter-services. | |

| Nature of financing | Individual leasing. The lessor fully finances the production or purchase of the leased property. |

| Separate leasing. The lessor purchases the asset partly at the expense of own capital, and partly at the expense of borrowed capital. |

Stages of financial leasing management

The key goal of managing financial leasing from the point of view of attracting loan capital is to minimize the flow of payments for servicing each leasing transaction.Management of financial leasing is carried out according to the following stages:

• Choosing a leasing object.

• Choosing a type of financial leasing.

• Coordination of the terms of the leasing transaction with the lessor.

• Evaluation of the effectiveness of the leasing operation.

• Organization of monitoring of timely leasing payments.

Evaluation of the efficiency of the leasing operation is based on a comparison of the total flows of payments with different forms of asset financing.

The effectiveness of cash flows is compared in present value according to the following basic decision options:

• Acquisition of assets for ownership at the expense of own financial resources.

• Acquisition of assets for ownership at the expense of a long-term bank loan.

• Asset leasing.

The basis of the cash flow of acquiring an asset into ownership at the expense of the company's own financial resources is the cost of its purchase, that is, the market price of the asset. These costs are incurred when the asset is purchased and therefore do not need to be brought to present value.

The basis of the cash flow of the acquisition of the asset for ownership at the expense of a long-term bank loan is the sum of the interest for the use of the loan and the main part of the loan to be repaid.

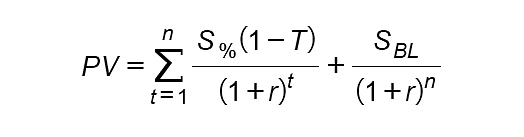

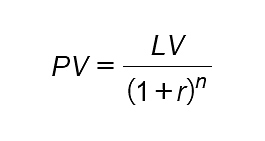

The calculation of this cash flow in present value is carried out according to the formula:

PV is the present value of a cash flow on a long-term bank loan.

S% is the amount of interest paid for the loan in accordance with its annual rate.

SBL is the amount of received loan, which is to be repaid at the end of the period

r is the annual interest rate for a long-term loan, expressed as a decimal fraction.

n is the number of intervals at which interest payments are calculated for the entire period

T is the income tax rate expressed as a decimal fraction.

The basis of the cash flow of leasing an asset is the upfront lease payment (if it is determined by the terms of the leasing agreement) plus regular lease payments for the use of the asset.

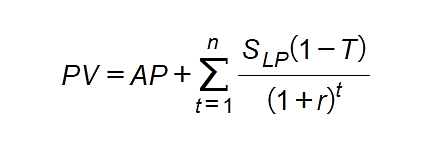

The calculation of the total amount of this cash flow in present value is carried out according to the formula:

PV is the present value of the cash flow associated with leasing a particular asset.

AP is an advance leasing payment stipulated in the leasing agreement.

SLP is the regular annual lease payment for the use of the leased asset.

r is the average annual interest rate on the capital market, expressed as a decimal fraction.

n is the number of intervals at which interest payments are calculated in the total time period.

T is the income tax rate expressed as a decimal fraction.

The above cash flow formulas assume that the value of the asset is fully written off at the end of its useful life. If after the expected period of use of the asset, it has a certain liquidation value, then its projected present value should be subtracted from the cash flow.

The liquidation value is calculated according to the following formula:

PV is the present value of the additional cash flow due to the sale of the asset (equipment, building) at its liquidation value after the expected term of its use.

LV is the projected liquidation value of the asset after the expected term of its use.

r is the average annual loan interest rate on the capital market (average interest rate on a long-term loan), expressed as a decimal fraction.

n is the number of intervals at which interest payments are calculated.

Bond loans for investment purposes

According to the legislation of most developed countries, the issue of bonds can be used as a source of borrowed capital by enterprises created in the form of joint-stock companies and some other types of business companies.As a rule, the company directs funds from the placement of bonds for the purpose of financing its strategic development, including large investment projects.

As a tool for raising borrowed capital, a bond loan has certain advantages and disadvantages.

Advantages:

• The issue of bonds does not lead to a loss of control over the company, as, for example, it can happen in the case of the issue of shares.

• Bonds can be issued with relatively low interest financial obligations (compared to bank loan interest rates or stock dividends) because they are securely backed by the company's assets and have priority in meeting claims in the event of bankruptcy.

• Bonds have greater exposure to financial markets than common stocks because of their lower level of risk to investors.

Disadvantages:

• Bonds cannot be issued to form a statutory fund and cover losses, while a loan can be used to overcome the negative consequences of the company's financial activity.

• Issuance of bonds is associated with significant financial costs and requires a long time. Due to the high level of costs for issuing and placing bonds, their issue is justified only for large projects that only large companies can afford.

• The level of the company's responsibility for the timely payment of interest and the amount of the principal debt when repaying the bonds is very high, since the collection of this debt in the event of a delay in payments is carried out through the bankruptcy procedure.

• After the bonds are issued, the average interest rate on the loan may become significantly lower than the fixed interest rate on the bond. In this case, the additional benefit will not be received by the company, but by the investors. At the same time, the company will bear higher costs for servicing its debt compared to the average market costs.

Thus, bond loans do not always have an advantage over other instruments for raising long-term capital.

Making a final decision requires a professional assessment of the market situation in the context of a specific investment project.

Classification of bonds

In modern market, companies can simulate bonds of various types, depending on the current needs, limitations and specifics of a particular business.Bonds are classified according to the main criteria given in the table below.

| Criteria | Description |

| Bond registration and circulation | Registered bonds |

| Bearer bonds | |

| Method of accrual and payment of funds | Interest-bearing bonds |

| Discount bonds | |

| Maturity of bonds | Short-term (less than 1 year) |

| Long-term (more than 1 year) | |

| Early redemption of bonds | Callable bonds |

| Non-callable bonds |

Bond loan management stages

The process of managing a bond loan is carried out taking into account the needs of business in borrowed capital and the classification of bonds discussed above.Bond loan management is carried out in the following stages:

• Research on the possibilities of effective bond issue.

• Determining the goals of attracting a bond loan.

• Assessment of the company's credit rating before issuance.

• Determining the volume of bond issue.

• Evaluation of terms and conditions of bond issuance.

• Determining the cost of a bond loan.

• Determination of effective forms of underwriting.

• Creation of a bond redemption fund at the enterprise.

The main goal of managing the company's bond issue is to ensure the attraction of the necessary amount of loan funds by issuing and placing securities of this type on the primary stock market.

Commodity loans for current business activities

Commodity loan, which is actually provided to enterprises in the form of deferred payment for materials or goods supplied, is becoming more and more widespread in commercial and financial practice.The purpose of using commodity loan is to meet current financial needs and reduce the total cost of borrowing capital. This financing tool has a number of advantages compared to other sources of borrowed capital.

Advantages:

• Commodity loan is the most flexible form of financing using borrowed capital in the context of the least liquid part of current assets, stock of goods and raw materials.

• This form of financing allows companies to smooth out fluctuations in seasonal demand for other forms of loan funds, since a large part of this demand is related to seasonal fluctuations in the formation of raw materials and goods stocks.

• This type of lending does not consider the supplied raw materials and goods as collateral, allowing the debtor to freely use the assets provided, i.e. sell them or use in production.

• Not only the borrower is interested in this type of credit, but also its suppliers, because the commodity loan allows them to increase sales of products and generate additional income. Therefore, commodity loan in modern economic practice is provided not only to first-class borrowers, but also to enterprises experiencing financial difficulties.

• Obtaining a commodity loan allows the company to shorten the financial cycle, thereby reducing the need for resources for the formation of current assets. This is determined by the fact that the specified type of financial obligations of the enterprise makes up the majority of its payables. There is an inverse relationship between the turnover period of the enterprise's accounts payable for commodity transactions and its financial cycle.

• Commodity loan is characterized by the simplest mechanism compared to other types.

Disadvantages:

• Targeted use of this type of loan allows meeting the company's need for loan funds for financing production stocks as part of current assets. This type of loan does not directly participate in other targeted types of financing.

• Compared to other debt instruments, it carries an increased credit risk, as it is essentially an unsecured loan. Accordingly, for the enterprise attracting this loan, it carries an additional threat for the supplier in case of deterioration of the market situation.

• This type of loan is very limited in time. The period of its use, not counting forced cases of its extension, is usually limited to several months.

In modern financial practice, the following main types of commodity loan are distinguished.

Table: Classification of commodity loans.

| Type | Description |

| Commercial loan with deferred payment under the terms of the contract | This is currently the most common type of commodity loan, which is established by the terms of the contract for the supply of goods and does not require special documents for its execution. |

| Commercial loan with payment of debt by the promissory note | A promissory note is necessary for establishing debt obligations. |

| Commercial loan based on an open account | It is used in business relations with regular suppliers for multiple deliveries of a pre-agreed range of products in small batches. In this case, the supplier transfers the cost of the shipped goods to the debit account opened by the company, which repays its debt in the contractual terms (usually once a month). |

| Commercial loan in the form of consignment. | In this case, the supplier (consignor) ships the goods to the trading company with an order to sell them. Payment is made only after the delivered goods have been sold. Consignment is considered one of the safest types of commodity loan. |

The management of commodity loans is carried out according to the following main stages:

1. Development of the principles of attracting commodity loan and its basic mechanisms.

2. Determination of the average period of use of a commodity loan.

3. Improving the terms of obtaining a commodity loan through negotiations.

4. Minimization of the cost of attracting a loan.

5. Increasing the efficiency of borrowed capital use.

6. Ensuring timely payment of debt.

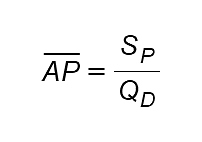

The average period of use of commodity loan is calculated by determining the average period of indebtedness for a number of previous periods using the following formula:

AP is the average period of indebtedness of the enterprise on commodity loan, in days.

SP is the average amount of the remaining debt on the commodity loan in the given period.

QD is the one-day volume of sales of products at their cost price.

The financial team analyzes the dynamics of this indicator for a number of previous periods and adjusts it for the planned period, taking into account the approved principles. An important task is the minimization of the cost of attracting each loan in accordance with its evaluation algorithms.

The management of the cost of commodity loan is based on the ratio of the price discount when making a payment for products and the period of use of this loan.

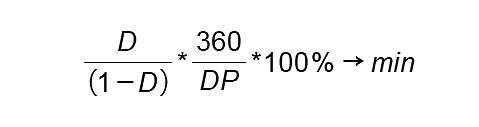

This mechanism of minimizing the cost of attracting a commodity loan can be represented by the formula below:

D is the price discount when making payment for products, expressed as a decimal fraction.

DP is the number of days of payment deferral in accordance with the terms of the commodity loan.

It can be concluded that the minimization of the commodity loan cost depends on the following:

• Price discount: the smaller it is, the lower the cost of attracting a commodity loan will be.

• The number of days of deferred payment: the longer this period is, the lower the cost of attracting a commercial loan for the enterprise.

Minimizing the cost of commodity loan, the financial team should be guided by the obvious principle.

For any commodity loan, the borrowing cost should not exceed the interest rate for a short-term bank loan. Otherwise it will be more profitable solution to settle with suppliers.

An important criterion for the effective use of commodity loan is the difference between the average period of use of loan and the average turnover period of the stocks it serves.

The higher the positive value of this difference, the more efficient the use of the borrowed capital.

It is important to ensure the timely payment of the debt on the commodity loan. If the loan repayment period exceeds the average period of inventory turnover, financial problems usually do not arise.

Otherwise, additional sources of funding should be involved. Commodity loan service is an important part of the current activity of trading enterprises, therefore it is included in the payment calendar and strictly controlled.

Modern financial system offers numerous ways to attract borrowed capital to finance business development and support its current activities.

If you are interested in long-term financing of large projects, refinancing or loan guarantees, please contact GCAM Investment Group.