After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

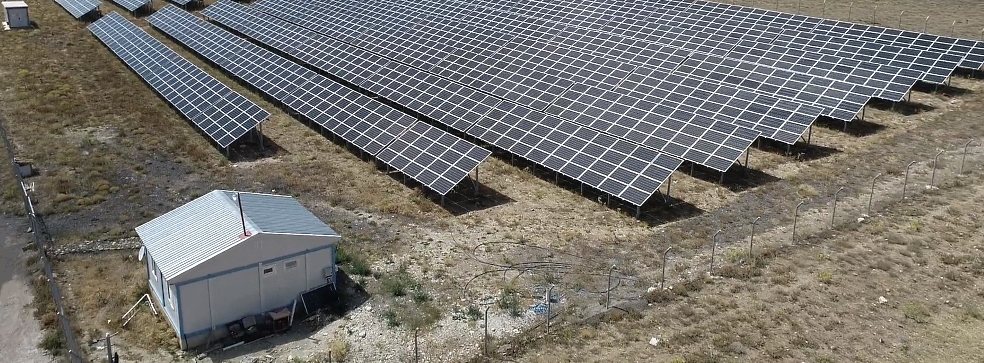

RES provide consumers with affordable energy generated from renewable resources and minimizing the ecological footprint of human activities in the long term.

At present, renewable energy sources account for more than 28% of the global energy mix, and their share in some countries already exceeds 90% (for example, Norway or Iceland).

Bank lending, leasing, advanced project finance (PF) schemes and green bonds have played an important role in the development of renewable energy projects based on solar, wind, geothermal, biogas and other types of energy.

The growing role of the government support, the improvement of the legal framework and the introduction of advanced financial instruments have contributed to the economic stability and ensured the energy security of many countries in the long term.

GCAM Investment Group offers financing for renewable energy projects in the EU and beyond.

We provide clients with financial modeling services, as well as carry out any pre-investment research and support projects at all stages of implementation.

Modern renewable energy financing instruments

The development of the energy projects market was accompanied by an evolutionary transformation of financial instruments and a change in the rules of the game.Along with banks and international financial institutions, which usually issue investment loans, in recent years EPC contractors, government agencies and revolving funds have played an increasing role in financing renewable energy projects. Against this backdrop, new financial instruments, including leasing and green bonds, also merit attention.

Investment loans

Investment loans play a key role in financing the construction of solar power plants, wind farms and other renewable energy infrastructure.This financial instrument, reinforced by government support in the form of guarantees, enables it to meet environmental commitments and meet national energy diversification goals within a short timeframe.

The developed countries have a clear advantage in this regard. High liquidity and stable financial regulations open up more opportunities for Western European and American banks to finance large energy capital-intensive projects, as well as raise funds for small projects with a high level of risk.

Almost all leading EU banks have specialized structural units that finance renewable energy projects, as well as allocate large funds to improve the level of energy efficiency of consumers.

These divisions have accumulated enough experience and expertise to quickly process applications and work flexibly with energy companies implementing these projects in Europe and beyond.

In addition, financing of renewable energy sources through banks in developing countries is associated with serious bureaucratic difficulties, lengthy processing of applications and rather high interest rates (sometimes twice as high as in Western Europe). These banks usually prefer projects to modernize existing projects or refinance, but do not seek to lend to greenfield projects.

Of course, long-term loans as a way to finance renewable energy sources have a number of limitations and disadvantages. In particular, the concentration limit and other formal restrictions aimed at minimizing credit risk lead to certain difficulties in financing expensive projects with a cost exceeding EUR 100-150 million.

However, for capital-intensive projects, there are a number of fairly effective syndicated lending instruments that have been successfully used in the development of energy projects in Europe, Latin America, the Middle East and in the states of East Asia during the construction of large facilities.

The most effective ways to support renewable energy include:

• Issuance of investment loans without collateral.

• Long-term loans for the entire period of the expected payback of the project.

• Interest-free loans with the participation of the lender in the future income.

• Support for renewable energy project finance instruments.

Recognizing the importance of the energy transition, many governments are already supporting green energy today, working with banks and financial institutions to improve lending conditions for renewable energy projects.

This includes the provision of government guarantees, support for project financing and direct involvement of government agencies in financing schemes.

It is advisable to activate bank lending for investments in the development of renewable energy sources through the creation of special credit products, the spread of self-financing, leasing and other forms and methods of financing investments.

General contractor loans

It is worth mentioning the financing of renewable energy projects through loans from the general contractor, which are sometimes offered by large engineering companies during the construction of facilities under an EPC contract (turnkey).This tool is widely represented in developed countries and requires a strong financial market.

EPC contractors (Engineering, Procurement and Construction) are responsible for the construction of power plants from scratch, taking responsibility for all project risks. As a rule, these are large companies with unshakable authority and strong financial positions that are able to attract financing on favorable terms.

Both banks and MFIs willingly cooperate with them, which makes it easier for customers to access borrowed funds.

In general, general contractor loans are considered a more expensive solution, however in practice this is not always the case. The fact is that a large engineering company with extensive business ties can often achieve more favorable conditions for the supply of equipment, which contributes to a significant reduction in the cost of a renewable energy project. Against the background of competition for large projects, customers get a real opportunity to successfully bargain and achieve the best conditions for their projects.

If you are interested in the construction of a solar power plant or a wind farm under an EPC contract, please contact our team.

GCAM Investment Group, together with international partners, is ready to offer comprehensive services for the development of renewable energy projects, including long-term financing.

Green bonds

Recently, the practice of financing investment projects for the development of renewable energy sources through the issuance of green bonds has been spreading in different countries.This is a special type of bonds, the prospectus of which provides for the targeted use of the attracted capital to finance an environmental project or its separate stage.

Originally, green bonds were issued by well-known financial institutions such as the World Bank, the European Bank for Reconstruction and Development (EBRD), as well as the European Investment Bank (EIB) and the International Finance Corporation (IFC). Now this financial instrument is widely used by numerous private companies, municipalities, government bodies.

Municipalities are most interested in green bonds because they provide local communities with a number of benefits.

Specifically, green bonds provide municipalities with the following:

• Implementation of large-scale environmental projects at the local level without the need for support from the central government.

• Attraction of large investments in strategic sectors of the municipality's economy with the aim of its harmonious development.

• Reducing the consumption of hydrocarbons and other fossil fuels while improving the environmental situation.

• Increasing the investment attractiveness of the region, the business climate and the competitiveness of the local economy.

Various countries are implementing policies to actively support the development of the green bond market.

The experience of the leading countries in the field of financing renewable energy projects is today being studied with interest and implemented everywhere.

For example, the United States uses incentives such as tax exemptions for municipalities, government cash subsidies to lower the interest rate on green bonds, and tax credits (investors in securities receive a tax credit, while issuing municipalities do not pay interest). Brazil exempts green bond issuers with wind energy projects. The EU has also repeatedly noted its intentions to reduce capital requirements for green investments.

International financial institutions are supporting the distribution of green bonds.

In particular, the World Bank provides expert assistance to governments in the issuance of sovereign green bonds.

The IFC is helping governments develop guidelines and procedures for the green bond market, and the European Investment Bank is helping to create a legal framework for green bonds to function.

Revolving loan funds

Another mechanism for financing RES projects in the future may be loans from revolving loan funds.The advantage of such funds is the ability to finance small projects that are important for the region (municipality). RLF is created to fund a specific area, as determined by investors.

Initial investments for the revolving fund can be attracted from the budget and through loans from local and international banks, private companies, organizations, government agencies as well as from private investors.

The establishment of RLF requires direct investment, so it is completely dependent on the inflow of external resources.

In the context of the development of the energy sector, especially renewable energy projects, the need to combine organizational efforts, resources and interests of all key participants in the production, distribution and use of energy is becoming urgent. Such cooperation will be mutually beneficial for both technical and economic reasons.

Co-financing: community involvement

Renewable energy infrastructure is widely scattered in space and time, and efficient energy production requires ensuring economies of scale both in terms of financial investments and in the search for large areas for allocation of capacities, development of technologies, material resources, etc.Some small consumers and potential producers do not have all the necessary resources, which determines the need for joint efforts and co-financing.

The practice of financing renewable energy projects in the world shows that one of the best options for pooling resources is the creation of joint utilities to generate energy from renewable sources, including community PV power stations. Such ventures can significantly simplify the financing of green power projects and the management of joint assets.

However, the most promising solution is the creation of energy cooperatives. An energy cooperative is a legal entity that is established to carry out joint activities for the production, storage and transportation of fuel and energy resources, as well as to provide other services in order to meet the needs of its members and in order to make a profit.

In its form, an energy cooperative is a voluntary autonomous association of participants (citizens, firms or organizations).

They can be founded to carry out joint activities aimed at decentralized energy production and consumption independent of energy companies.

State support for financing renewable energy projects in the world

The global energy transition and the abandonment of scarce and hazardous fossil fuels have been accompanied by the development of new effective instruments, schemes, methods of financing renewable energy sector.In particular, a system of state support for RES projects is developing at the level of local budgets, central governments and even international organizations and financial institutions.

Renewable energy financing schemes are developed taking into account the risks and vulnerabilities that necessarily accompany the implementation of innovative projects based on expensive technologies and small-scale production of technically complex equipment. In particular, national measures to support innovative projects provide a number of economic and competitive advantages for renewable energy projects.

International and state aid occupies an important place among the sources of financing for energy projects. It can be carried out in various forms, including the provision of targeted government funding, concessional lending programs, indirect support, and so on.

Along with state funding, municipal programs are gaining weight, which make it possible to mobilize the resources of municipal budgets to support investments in the field of renewable energy sources and energy efficiency, as well as compensation for interest on targeted loans or the introduction of mechanisms of municipal guarantees.

For local communities and local budgets, redirecting cash flows to the development of green energy at the local level performs the following functions:

• Diversification of economic activities.

• Growth of local business income and creation of new jobs.

• Replenishment of the local budget from taxes.

• Reducing the dependence of the local community on budget subsidies.

• Increasing the economic stability of the region.

• Improvement of ecology, health and quality of life of the population.

It is important that along with the use of internal resources to support the development of renewable energy, municipalities can actively attract funds from other international financial organizations, banks and other credit institutions.

Renewable energy sector development problems

The main problems hindering the development of renewable energy in developing countries are rooted in weak legislation, low investment attractiveness and, as a result, in insufficient investment provision.The shortage of cheap sources of financing leads to a situation when promising projects are sorely lacking funds to meet the material and technical, engineering, personnel, organizational and management and other needs.

Renewable energy leaders such as China, USA, Japan, Netherlands, UK and Germany have overcome these challenges. Many developing countries such as Brazil and India have made significant strides in recent years with persistent policies to support green energy development.

Table: Top 10 countries in terms of total installed RES capacity (IRENA, 2019)

| Rank | Country | Capacity, GW |

| 1 | China | 758,6 |

| 2 | United States | 264,5 |

| 3 | Brazil | 141,9 |

| 4 | India | 128,3 |

| 5 | Germany | 125,4 |

| 6 | Canada | 101,0 |

| 7 | Japan | 97,5 |

| 8 | Italy | 55,3 |

| 9 | Russian Federation | 55,2 |

| 10 | Spain | 54,6 |

Experience shows that an effective form of financing renewable energy projects is the creation of energy service companies.

These are business entities that implement energy saving measures at the expense of their own, borrowed or borrowed funds, without using budgetary subsidies and subsidies.

Now the activities of such companies are currently more focused on the implementation of projects in the field of energy conservation than in the field of renewable energy generation. However, in the future, it is advisable to expand this activity to the production of green energy.

It is clear that the introduction of new financial instruments along with the improvement of local energy and financial legislation will help to achieve the goals of the energy transition and expand business opportunities.

If you are looking for a long-term loan to finance renewable energy projects in Europe, Latin America, the Middle East or other regions of the world, contact an GCAM Investment Group representative and schedule a consultation at any convenient time.

We are ready to provide a full range of financial and engineering services for your project.