After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

For this reason, investment in the mining industry in Spain is attractive to dozens of large foreign companies such as Vale, Rio Tinto, Glencore, Anglo American and many others.

With the value of mined minerals of about 3.8 billion euros per year, the mining industry occupies one of the leading places among the EU countries.

Spain has an extremely wide range of mineral resources, including rare earths, making the country an attractive investment amid rising demand for batteries and electrical equipment. Spain is also a large producer of copper, tungsten, nickel, zinc, magnesite, lithium and a number of other minerals critical to modern economy.

The country is of the world leaders in terms of explored tungsten reserves, playing an important role in providing European industry with strategic raw materials.

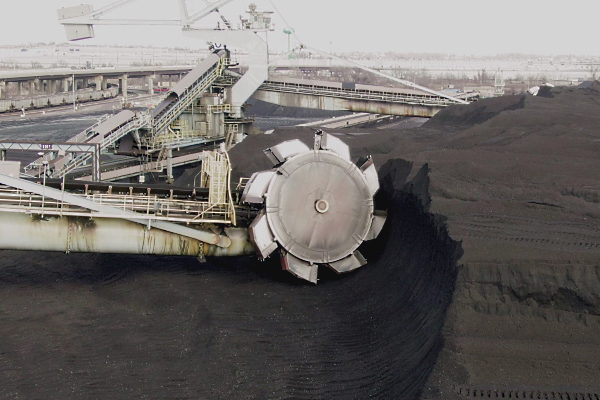

Mining refers to a large-scale industrial activity consisting in the selective extraction of minerals, with their subsequent processing to achieve the desired economic effect.

The term mining includes, in addition to underground or surface mining operations that require the use of mining technologies and operations necessary for processing the substances mined, such as crushing, washing, concentrating and for preparing these substances for sale to industrial consumers.

The construction of mines, quarries, processing plants, warehouses and infrastructure requires investments of hundreds of millions of euros, and the largest mining projects are estimated at billions of euros. Many millions are required by mining companies for exploration work, since most of the easily accessible deposits close to the surface have already been exploited.

This is a huge investment that usually needs to be raised in the early stages of a project, when the prospects for extracting valuable minerals and the payback period of a particular project are uncertain.

GCAM Investment Group, a company with international experience in financing large projects, offers long-term loans for mining projects in Spain.

We are ready to develop a customized financial model for our customers, offering optimal investment solutions at all stages of the project.

History and development of the mining industry in Spain

Spain has always been known for its vast deposits of metals and non-metallic ores, which, along with a convenient geographical location and access to seaports, gave the country incredible trading advantages.Despite this, until the second half of the 20th century, the development of the mining sector in Spain was somewhat inferior to other large Western European countries.

For most of the 19th century, low level of mining was attributed to a number of historical factors.

First, there was a combination of lack of capital and knowledge. Industrial demand in Spain, given the delay of the industrial revolution, was very low at the time and did not have enough impact on the mining sector.

Secondly, outdated legislation placed many obstacles to the private initiative by declaring the mines the property of the Crown, as established by the Mining Act of 1825.

The complex path of economic reform and technical innovation made possible the significant progress of the mining industry in Spain only at the beginning of the 20th century.

However, this growth was interrupted by the debilitating Civil War, when mining production declined by more than 25%. In the post-war years, foreign investment in mines and ore processing plants quickly restored the sector and set it on a path of sustained growth.

Today, the mining industry is deeply integrated into European and global markets, being a strong and competitive player in many areas, especially in the supply of metal ores and rare earth elements.

The main mining products in Spain include the following:

• Energy products: crude oil and natural gas.

• Metal minerals: iron, copper, zinc, tungsten, tin, lead, mercury, tantalum, gold and silver.

• Construction minerals: gravel, limestone, dolomite, marble, granite, gypsum, alabaster.

• Industrial minerals: quartz, bentonite, glauberite, magnesite, potash, sepiolite and others.

In 2021, the mining sector included more than 2.6 thousand mines with a total number of employed workers of 17 thousand people throughout the country.

The extraction, processing and trade of minerals employs approximately 35 thousand citizens.

The total production of the mining and quarry industry in Spain in 2020 was about 3.78 billion euros. A significant part of the industry's output came from metallic minerals, and fossil fuels accounted for only a very small part. The decline in both output and employment reflects the phasing out coal mining in favor of renewable energy sources.

Spain extracts quarry stone, being one of the regional leaders in the production of granite, gypsum, limestone, marble and a number of other building materials. Metal mining in this country is really booming, with a total production of over 1 billion euros in 2021.

Table: Development of the mining industry in Spain in 2012-2020

|

Year

|

Total number of active mines and quarries

|

Production value of the mining sector, million euros

|

Total number of employees

|

|

2012

|

3208

|

4341

|

23500

|

|

2013

|

2942

|

3614

|

20300

|

|

2014

|

2896

|

3455

|

19400

|

|

2015

|

2854

|

3475

|

17700

|

|

2016

|

2807

|

3544

|

19300

|

|

2017

|

2760

|

4375

|

18800

|

|

2018

|

2732

|

4108

|

16800

|

|

2019

|

2665

|

3756

|

17200

|

|

2020

|

2629

|

3781

|

16800

|

In 2021, mining companies produced 149.5 thousand metric tons of copper (+21% compared to the previous year), 90 thousand metric tons of zinc (+170%), as well as 11.8 thousand metric tons of lead, among others.

This is a significant contribution to the independence of the European economy. Investment projects in these areas continue to develop, fueled by the growing need for electronics and renewable energy technologies at the global level.

Investments in mines and quarries by autonomous communities

The number of mining sites in Spain has decreased annually over the past years, but the country still remains an important source of strategic raw materials for European industry and one of the largest suppliers of rare earth elements.As old mines deplete and their profitability decline, investors are increasingly focusing on the largest deposits of minerals and additional funding for exploration.

Andalusia is located on a unique geological belt, where a huge number of metal ore deposits come to the surface. Not surprisingly, this region accounts for more than a third of the value of all mined minerals in Spain. Catalonia, Galicia, Castile and Leon and Asturias occupy important places in the mining industry, while the rest of the regions are far behind the leaders in terms of total production and value of mined minerals.

Together, the aforementioned autonomous communities account for the majority of the country's mining production and employment.

Table: Distribution of mineral production by autonomous communities of Spain in 2019

| Region | Share in total production | Basic minerals |

| Andalusia | 40% | Copper, lead, zinc, silver, marble |

| Catalonia | 12.1% | Hydrocarbons, potash, wide variety of industrial mineral resources |

| Castile and Leon | 9.6% | Tungsten, slate, glauberite |

| Galicia | 7.8% | Tin, tantalum, kaolin, quartz, granite |

| Castilla La Mancha | 4.4% | Sepiolite, bentonite, thenardite |

| Asturias | 4.3% | Gold, fluorite, thermal coal |

| Madrid | 3.9% | Glauberite, sepiolite, granite, gypsum |

| Aragon | 3.8% | Kaolin, refractory clay |

| Valencia | 3.6% | Sea salt, kaolin, marble |

| Murcia | 1.9% | Marble, salt |

| Basque Country | 1.7% | Limestone |

| Extremadura | 1.5% | Granite, lithium and others |

| Navarre | 1.3% | Limestone, magnesite |

| Balearic Islands | 1.3% | Sandstone, limestone |

| La Rioja | 1.2% | Natural gas, ophite, limestone |

| Cantabria | 0.8% | Limestone, salt |

| Canary Islands | 0.7% | Industrial minerals |

| Ceuta | Less than 0.1% | Limestone |

With regard to investment in the mining sector in Spain, many local and international companies are interested in the extraction of rare earth elements, paving the way for energy security and the sustainability of the European economy.

Of particular interest is Extremadura, an autonomous community close to the huge lithium deposits in neighboring Portugal.

Lithium mining is now well funded in Spain, as evidenced by the development of the San Jose Valdeflorez and Las Navas mines. These investment projects give impetus to the development of the production of batteries and other high value-added electronic components in Spain.

Among the major investment projects of recent times, the Iberian Belt West (“IBW”) project, funded by Emerita Resources Corp., should be noted.

This project includes a number of large sulphide deposits containing significant amounts of gold, silver, copper, zinc and lead.

Another company in the market, Atalaya Mining Plc, recently announced the discovery of massive sulphide deposits in Mojarra Trend, as part of the Proyecto Masa Valverde.

These sources of copper, zinc, lead and silver will help provide industrial consumers in Spain and other European countries with affordable raw materials for electronic components in the coming years.

In addition, at the end of 2022, Pan Global Resources announced the expansion of its La Romana Deposit project in the Iberian Pyrite Belt, southern Spain. The company mines near-surface copper, silver and tin in the area. This is one of many investment projects to develop the famous region and meet the growing global demand for metals.

Investments in the mining sector of Spain during the green transition

The mining industry in Spain has long played a strategic role as a supplier to the industry of basic minerals and fossil fuels, so investment in the development of mines, quarries and ore processing plants stimulates key sectors of the economy.The European Union has been developing the Raw Materials Initiative since 2008, the aim of which is to provide access to valuable raw materials, encourage their supply from European sources and improve the efficiency of resource use, as well as encourage recycling in order to reduce dependence on third countries.

The so-called “new technology minerals”, which are used to produce countless devices, have been booming in the last few years.

Demand for copper, lithium, graphite and coltan (the source of niobium and tantalum) for the manufacture of batteries, computers and other innovative equipment plays a special role here. Just half a century ago, most of these elements were of no interest to anyone, but today they have become indispensable.

As the last coal mines and thermal power plants shrink and are about to close for good, metals are seen as the treasure of the future.

According to experts, in the coming years, the production of these metals will increase by 500% due to the need to produce clean energy.

Spain is the second largest copper producer in Europe. Most of this mineral is found in the so-called pyrite belt in Andalusia (it extends from the southwest of the peninsula to Portugal).

In particular, it covers part of Huelva, Seville, Algarve and Alentejo.

Rising prices for this mineral due to demand from China have led to the fact that investment in copper mines in Spain has increased significantly.

International giants such as Rio Tinto have already taken full advantage of the region to meet growing global demand.

One of the factors that has dramatically increased the price of copper is the spread of electric vehicles. Spain is rich not only in copper, but also in lithium, gold, coltan, rare earth elements. This is of strategic importance for the continent as the Europe tries to limit its dependence on imports.

The European Raw Materials Alliance (ERMA) and other organizations constantly monitor the market and help increase investment in the extraction and processing of strategically important mineral resources in Spain and other EU countries.

The lists of critical raw materials for European industry are regularly revised and today include minerals with great potential in the mining industry, such as lithium. Technological innovation and the EU's rapid transition from fossil fuels to green energy are powerful drivers for financing the mining sector in Spain.

The decarbonization requires access to new types of minerals necessary for the development of renewable energy sources and environmentally friendly technologies. Thanks to the sustainable exploitation of more than 70 minerals and rocks that can be found in Spain, it has become possible to establish the production of batteries for electric vehicles and advanced electronic equipment.

Large investments in the extraction of rare-earth elements (REE) in Spain contribute to limiting CO2 emissions and decarbonizing the economy on a European scale.