After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

This brought the total funding of this promising project to 310 million euros, and the company does not intend to stop there.

GCAM Investment Group monitors the changing business landscape and keeps track of current trends in the aerospace industry.

Our team is ready to offer companies from all over the world long-term private capital for the construction of industrial facilities, infrastructure development and the growth of start-ups in high technology industries.

Contact us for details.

General information about the Isar Aerospace company

Isar Aerospace was founded in March 2018 by aerospace engineers Daniel Metzler (CEO), Markus Brandl and Josef Peter Fleischmann.The company is based in Ottobrunn near Munich, Bavaria. The founding members were previously active in the Rocket and Space Science Working Group (WARR), a student group at the Technical University of Munich, which had already developed its own propulsion systems and a suborbital rocket.

World-famous heating equipment manufacturer Viessmann and venture capitalist UVC Partners, a company owned by two former SpaceX employees, participated in the first round of funding in the summer of 2018. At the end of 2019, Isar Aerospace received, among other things, $17 million from Airbus. At the end of 2020, another 75 million euros were raised. Later in June 2021, Isar Aerospace raised another €57 million from investors. After several funding rounds, 140 million euros were available in October 2021, and by the end of December 2021, the capitalization of the space company had increased significantly. Isar Aerospace and its projects are supported by the start-up funding program of the European Space Agency.

The company plans to make the first flight of its 28-meter Spectrum rocket this year. The rocket is a micro-launcher designed to launch small satellites, such as Cubesat, and medium-sized satellites into Earth orbit.

The launch is expected to take place in the second half of 2023.

In early 2019, the Ludwig Maximilian University of Munich (LMU) announced the development of a research satellite that will be launched into orbit by a Spectrum rocket in 2026.

Norway and Sweden were initially discussed as possible launch sites. Isar Aerospace received the first commercial order to launch the Spectrum from Airbus Defense and Space in April 2021. We are talking about the launch of an Earth observation satellite. The date of this mission was not called.

The necessary rocket tests and the two launches themselves are funded by the European Space Agency (ESA) with 11 million euros. This grant is provided under ESA's Commercial Space Transportation Services and Supports (C-STS) programme.

Isar Aerospace received it as the winner of the "German competition for micro-launchers" of the German Aerospace Center.

In September 2021, it was announced that Isar Aerospace had signed a launch agreement with OroraTech. The plan was to put at least ten satellites into sun-synchronous Earth orbit. They should take place between 2022 and 2026. In October 2021, a launch agreement was also signed with EnduroSat, which provides for the launch of several satellites between 2022 and 2025. In June 2022, the Italian company D-Orbit signed a contract with Isar Aerospace to launch an ION satellite launch vehicle into a sun-synchronous orbit, probably in 2023.

After the last round of funding in the spring of 2023, Isar Aerospace is considered the most capitalized private space company in Europe. In addition to this ambitious Munich start-up, its two German competitors Hyimpulse and Rocket Factory Augsburg also want to go into space this year, with Hyimpulse being a suborbital rather than an orbital launch.

In general, the German aerospace industry has recently become the object of close attention both from private investors and large financial institutions.

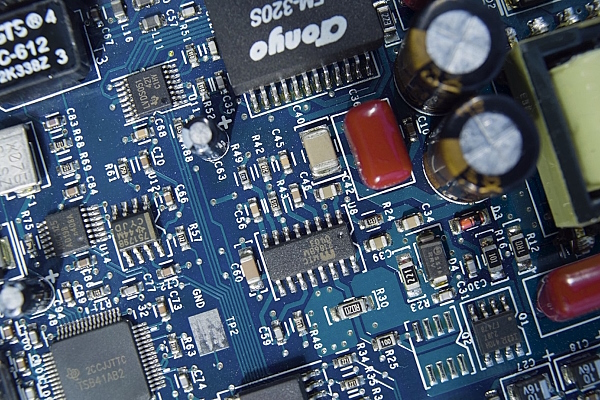

The urgent need for scientific progress and technological independence of Europe has become a driver that determines the powerful flows of capital in the German industries of space technology, electronics and semiconductors.

Spectrum rocket: European investment provides a breakthrough

Despite the fact that Germany has been an important link in the global aerospace industry for decades, the country has not yet developed and launched mass-produced commercially available space rockets.Recent large-scale European investment, ESA support and huge industrial potential could turn the tide, making Germany one of the leading space powers in the future.

The Spectrum rocket is an innovative liquid-propellant launch vehicle being developed as an affordable tool for launching small commercial satellites at an optimal cost-benefit ratio. It is currently planned to launch a two-stage rocket capable of delivering up to 1000 kg of payload to low Earth orbits and 700 kg to sun-synchronous orbits.

The first stage of the rocket is to be powered by nine liquid-propellant engines called "Aquila" with a total thrust of 675 kN. For the second stage, a vacuum version of the engine with a thrust of 94 kN and the possibility of multiple ignition is planned. The latter allows the rocket to perform complex orbital maneuvers, such as launching multiple satellites into different orbits. The engines run on "light hydrocarbons" (propane) and liquid oxygen.

In March 2023, Isar Aerospace announced that it had conducted 124 tests of the Aquila-powered Hotfire at the Esrange Space Center in Sweden over the past 12 months. In an interview with European Spaceflight, CEO Daniel Metzler confirmed his intention to make the first Spectrum flight from Andøya Cosmodrome by the end of 2023. The financing of these works fell on the shoulders of private capital, provided by seven companies from Germany and other countries.

By the way, the Andøya Cosmodrome in Norway has a long history of cooperation with the German aerospace industry. In the 2000s, the launch site was chosen by the German Aerospace Center (DLR) to launch the SHEFEX I and SHEFEX II experimental systems.

The previously mentioned German company Rocket Factory Augsburg (RFA) planned to make the first flight of its Bavarian launch vehicle RFA One at Andøya in 2022, but the company has since announced a postponement of the date and change of launch location.

The presence of own test sites, launch sites, industrial and logistics links of the new space program within the European Union further stimulates the industry. Large private investments and financial support for space startups like Isar Aerospace are critical for Europe, which must maintain its technological superiority and independence in the face of rapidly intensifying global competition.

About investors and main project participants

The revolutionary German aerospace project is co-financed by several capital providers.In addition to the 7-Industries Holding B.V., Earlybird Venture Capital, HV Capital, Lakestar, Lombard Odier Investment Managers, Porsche SE, UVC Partners and Vsquared Ventures, the investors in Isar Aerospace now also include Bayern Kapital, a venture capital and growth investor for start-ups with innovative technologies. In addition, Porsche SE and HV Capital are to join the supervisory board of promising space company.

Porsche SE is a world-famous technology giant whose presence takes the investment project to a whole new level. Porsche Automobil Holding SE is a German automotive holding that controls the Volkswagen AG concern, which produces cars under the VW, Audi, SEAT, Skoda, Bentley, Bugatti, Lamborghini, Porsche, Scania and MAN trademarks. In the Forbes Global 2000 list of the largest companies in the world for 2022, the holding took 673rd place.

However, the company's interests are not limited to the automotive business and affect many sectors of the European industry.

Lombard Odier Investment Managers is part of the large international group Lombard Odier Group, founded back in 1796. This asset management company helps clients from all over the world make the right investment decisions, guided by advanced technologies and experience. We can safely say that the participation of such partners increases the credibility of the new aerospace project.

Earlybird Venture Capital, a Berlin-based venture capital firm, has been active in the investment landscape since 1997. Focused on growth-stage companies in Europe, the firm specializes in a diverse range of sectors such as consumer services, information technology, SaaS, healthtech, life sciences, blockchain, fintech, real estate, e-commerce, big data, and healthcare.

Lakestar, a company with more than 10 years of experience in the European business ecosystem, has raised more than 1.5 billion euros for investment during its life. The Isar Aerospace investment has become one of the flagships in her portfolio.

However, this can be said about all the participants in the historical investment project.

Founded in 1995, Bayern Kapital GmbH is a venture capital firm based in Landshut and operates as a wholly-owned subsidiary of Bavarian LfA Förderbank.

Serving as the premier venture capital organization for the Land of Bavaria, this firm is committed to providing equity capital financing to early-stage and growth-phase technology companies. With a portfolio comprising thirteen venture capital funds and a total volume of approximately 700 million euros, Bayern Kapital has a proven track record of identifying and investing in promising start-ups.

Most of the companies involved in financing the project are related to Bavaria in one way or another. Founded in 2000, HV Capital Adviser GmbH, a venture capital firm based in Munich, Bavaria, also specializes in financing innovative projects. Vsquared Ventures is another Munich-based firm providing capital for innovative and high-risk projects.

According to Monika Steger (Bayern Kapital), the financing of the new aerospace project was due to the urgent need for a cheap and efficient launch of spacecraft into orbit. The technologies proposed by Isar Aerospace engineers have opened up such opportunities.

According to Isar Aerospace co-founder and CEO Daniel Metzler, the company is "opening access to space that is badly needed by commercial, institutional and government customers."

The completion of the Series C funding round is an important milestone in launching into orbit this year from Andøya Cosmodrome in Norway, Metzler said.