After receiving the necessary documents (application form and project presentation), our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

These trends require careful selection of the most effective investment financing instruments for corporate groups seeking to expand their business.

The globalization of international capital markets is facilitating the creation of multipurpose structures commonly referred to as holdings in the financial literature.

The purpose of the article is to provide a brief overview of funding sources for holdings with an emphasis on intra-group funding. The classification and the most important features of the methods of financing the investment activities of groups of companies are described in detail.

If you are interested in financing large investment projects or are looking for professional consulting services, contact the financial team of ESFC Investment Group.

Traditional sources of financing for corporate groups

Holdings use traditional sources of funding, but the complexity of the corporate group structure provides more opportunities in this regard.In addition to traditional loans, groups of companies can use corporate tools that are not available for single companies that operate independently.

Funding sources can be divided into four main groups:

• Funding through contributions from founders.

• Self-financing through profit and amortization.

• Debt financing (loans).

• Hybrid financing.

Funding at the expense of the founders consists in the contribution of free funds by investors and shareholders to the capital of the company.

This form of financing for large companies encompasses sources such as share capital contributions, proceeds from the sale of shares in excess of par, venture capital and investor money.

Self-financing usually consists of using profits and depreciation charges from existing tangible fixed assets and intangible assets to finance the company. This source is considered the most accessible, mainly used for growth and business development.

Debt financing, which is a popular source of financing, means the use of loans, issuance of debt securities and trade credits.

This includes various project finance tools.

Hybrid finance is a combination of different forms of finance with a particular focus on traditional instruments and derivatives.

This means that one form of financing can be replaced by another. Most often, this is the replacement of debt financing with equity financing (purchase of bonds with the option to repurchase the issuer's shares).

The listed sources of funding for corporate groups are summarized in the table below.

Table: Sources of financing for the investment activities of the corporate group.

| Sources of financing | Economic category | Capital provider | Characteristics |

| Financing investment activities through contributions from founders, shareholders and investors | Contributions to the authorized capital of the holding | Investor (shareholder, business founder) | Formation of the authorized capital |

| Agio | Shareholders | The offering price of shares is higher than par | |

| Additional investor funds | Investors | Increase in additional capital | |

| Venture capital | Investors | Additional capital | |

| Self-financing | Capitalization of the holding's profit | Meeting of shareholders | Increase in additional capital |

| Depreciation | Legal entities that are part of the holding | Flexible use for various purposes | |

| Debt financing | Bank loans | Banks and other financial institutions | Payment of principal, interest and commission |

| Issue of debt securities | Wide range of investors | Obligation to redeem on clear terms | |

| Trade credits | Suppliers and contractors | Short-term liabilities | |

| Hybrid financing | Complex instruments such as bonds convertible into stocks | Various lenders | Shifting from debt to equity financing |

Corporate financing of investment activities of subsidiaries included in holdings

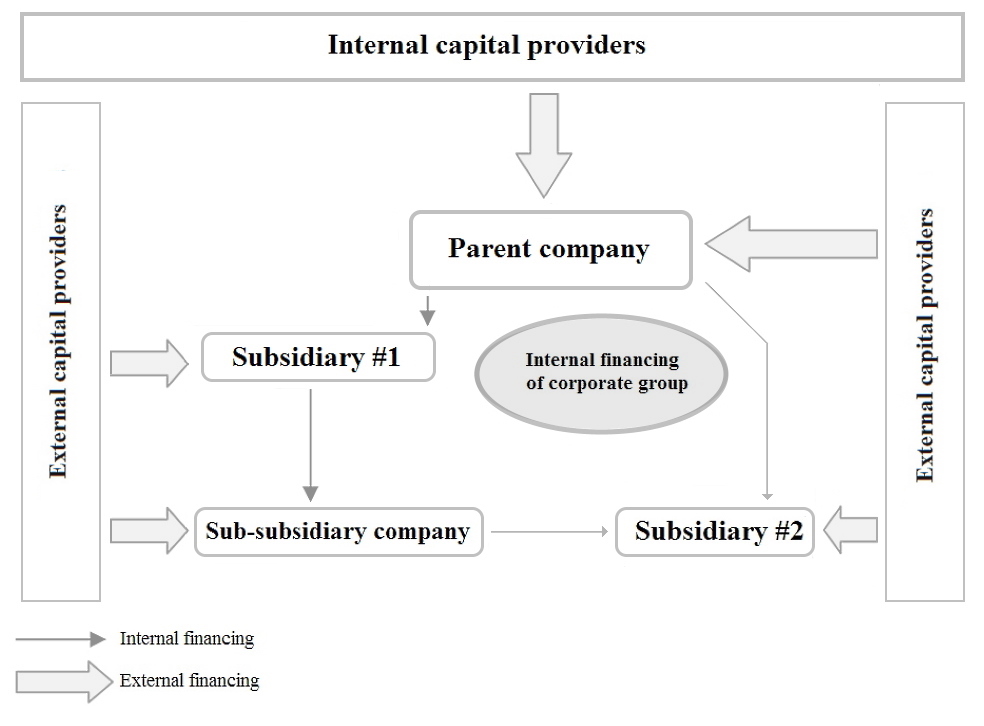

Corporate financing of investment activities within a group of companies can be divided into the following categories:• Internal financing in the form of the purchase of shares of one of the companies by another company within the group and the issuance a loan to one of the companies of another.

• External financing, which is carried out by attracting capital from interested investors or financial institutions from outside.

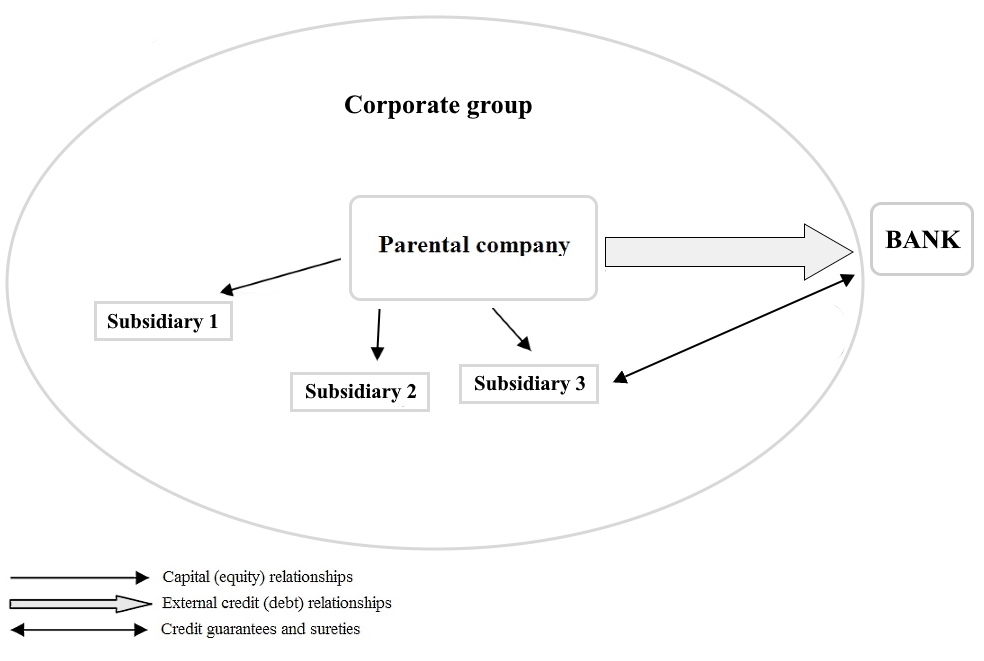

The above forms of financing corporate groups are presented in Figure 1.

Internal financing in a group of companies is the main tool for managing holdings.

The parent company, based on the chosen global strategy and financial strategy, determines the development directions of the entire holding, including the choice of:

• shares purchased and resold by subsidiaries or sub-subsidiaries;

• the degree of participation in the capital of subsidiaries and the level of internal financial support of these companies in the form of attracted external capital;

• financing mechanisms for each company in the holding.

If the parent company is the source of internal financing, then, depending on the form of capital provided to the subsidiary and the method of its transfer within the group, four financing options can be distinguished:

1. Equity capital remains internal capital, for example, by increasing the share capital of subsidiaries from the capital of the parent company.

2. Equity becomes external capital by providing strong guarantees to the subsidiary with the capital of the parent company.

3. Borrowed capital becomes equity, for example if the parent company takes out a loan to increase the capital of the subsidiary.

4. The borrowed capital remains external capital if the parent company takes out a loan and subsequently transfers it to the subsidiary.

Figure 1: Structure of investment financing in a corporate group.

The level of participation of the parent company in subsidiaries (see the first and third of the above-mentioned options for financing the holding) is closely related to the company's profit distribution policy.

We are talking about the payment of dividends to the parent company and other owners of shares and securities of this company. In particular, it is possible to keep the profit inside the subsidiary.

Similar options can be considered when the subsidiary is funded by another company in the group.

If we assume that the subsidiary finances the activities of other companies, then the so-called capital pyramid effect may occur within the holding.

This is manifested in the fact that the parent company's control over lower-level companies becomes disproportionate to its real financial participation.

External financing of investment activities in a group of companies means that subsidiaries and sub-subsidiaries independently raise capital from outside. Here we can talk about the traditional forms of financing for independent companies. In this form of financing, there is a problem with determining the degree of financial freedom of the companies included in the holding.

In some groups, external financing is arranged by the parent company or through a specialized finance company.

The centralization of decision making at the holding level is in line with the expectations of external capital providers seeking to assess their risk taking into account the capital ties between companies within a single corporate group.

The pyramid effect assumes that all subsidiaries will independently incur debt obligations outside the group, having their own capital at their disposal. This situation can lead to multiple uses of the same capital in different credit processes until the so-called pyramid effect is created.

The latter is extremely dangerous not only for lenders, but also for business owners. The company may become insolvent as a result of poorly assessed risk associated with growing indebtedness.

Sources of financing for investment activities of holdings in the context of centralized decision-making

Financial experts classify funding sources for corporate groups according to the degree of centralization of corporate decision-making authority into centralized, decentralized, partially centralized and mixed sources.Each of them provides companies with unique advantages, but they have certain limitations in practical use.

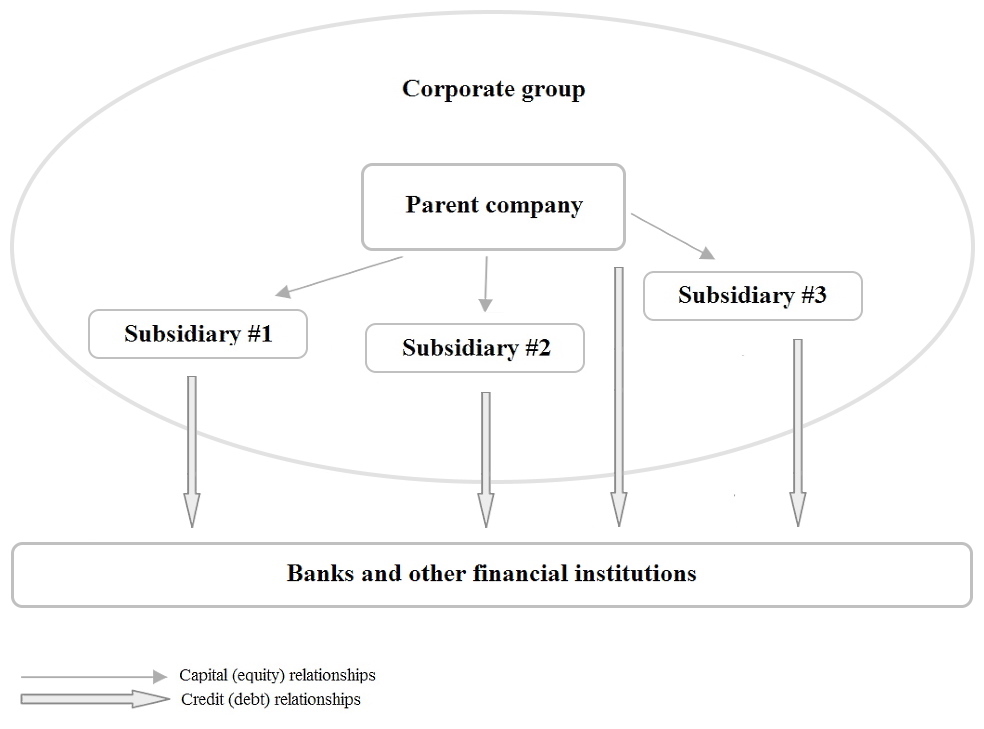

Decentralized financing of investment activities of holding companies occurs when each division of the group acts as a separate debtor, taking on the burden of collateral and debt repayment. This prevents the group from taking advantage of the financial synergy effect and, therefore, the companies attract fewer resources.

In this form of financing, the decision-making power of the parent company is limited solely to determining the level of its capital obligations in the subsidiary and deciding on the distribution of profits. The parent company monitors the financing result using corporate governance instruments and on the basis of financial statements sent by the subsidiary.

The advantage of decentralized finance is that it is strongly linked to the development of each borrowing company.

However, this method of organizing financing severely limits the potential benefits that the group can receive from the cooperation of companies in this area.

Figure 2: Decentralized financing of investment activities of a corporate group.

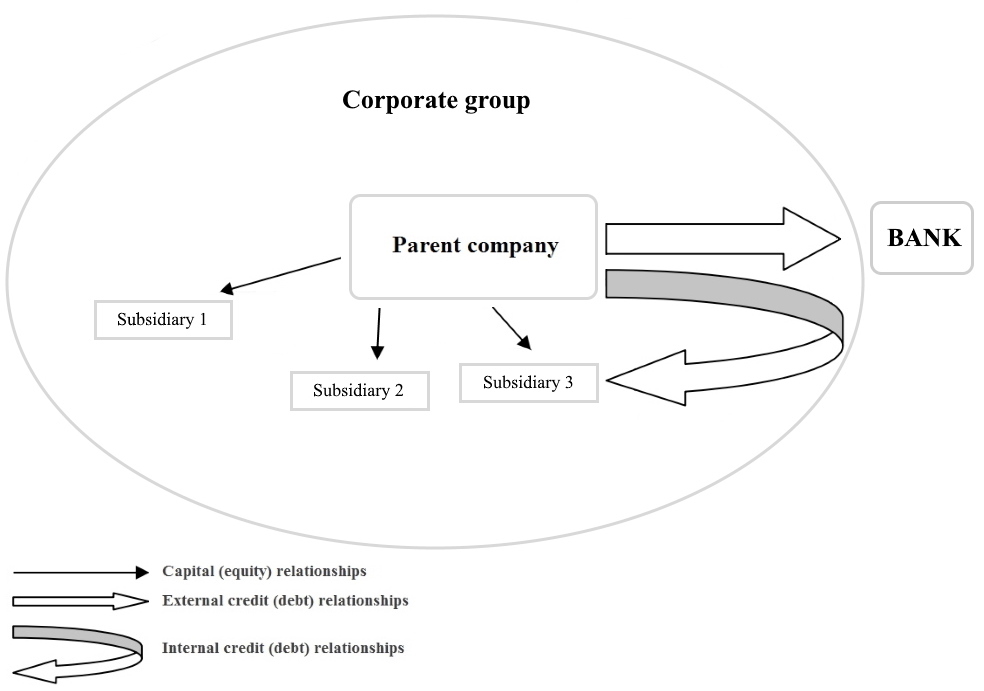

Centralized financing of the investment activities of a corporate group refers to the financing of one company in a group through another company in the same group.

It is most often dominated by a stronger company with a high creditworthiness, which attracts borrowed funds (loans) in order to finance weak companies.

This form of financing also means that any financial decisions within the group are made by the parent company. The parent company, in addition to determining the level of its capital liabilities in each company, decides to use other forms of internal financing, regulates equity participation in these subsidiaries, determines the capital structure and raises capital from outside.

The centralization of financing is aimed at obtaining the maximum benefit from the cooperation of companies, measured by the lower cost of capital in the investment activities of the holding. This approach also means a significant increase in the parent company's supervision over its subsidiaries.

On the other hand, the use of centralized financing means the risk of a significant increase in the costs of financing processes in the group of companies, as a result of the complexity of decisions taken at the central level.

Some sources also mention the high risk of neglecting financial needs, as reported by some companies.

Figure 3: Centralized financing of investment activities of a corporate group.

Funding for holdings can be partially centralized. In these cases, a company interested in raising capital itself applies for it, and the role of other companies in the group is to provide guarantees and sureties.

The method of partially centralized financing of investment activities is shown in Figure 4.

Mixed financing is characterized by the use of joint decisions of the parent company and the subsidiary to finance the latter. The need for financing of subsidiaries is determined by them independently, but each such decision must be preceded by the approval by the parent company of methods to cover financial needs in the context of the global economic goals of the corporate group.

With this method of financing, a special financial company can be created, responsible for the attraction and distribution of financial resources.

There are several types of financial companies, including those listed below:

• A company that finances the rest of the holding companies only in the form of external capital. A subsidiary of the parent company is created, which itself does not have stakes in other companies, its capital often does not exceed the minimum level required to create a legal entity, and its creditworthiness is guaranteed by the parent company. The purpose of this company is to raise and distribute capital between the companies of the group.

• A company that finances other companies in the group in the form of external or equity capital. It is also a subsidiary company, but shares of the parent company in other structural units are transferred to it, which also implies the establishment of some responsibilities for the management of the holding.

Figure 4. Partially centralized financing of holdings.

Financial companies are most often created in holdings with a wide international presence.

The purposes of creating such structural units within the corporate group are as follows:

• Minimization of the cost of capital.

• Rational distribution of competences in the field of financing within the group.

• Minimizing the cost of raising and using capital at the expense of scale.

• Access to specialized group finance services.

• Optimization of taxes paid by the group as a result of financing.

• Taking advantage of the competitive advantage associated with the location of the finance company in the host country, which can result from local legislation, access to financial markets, lower fixed personnel and administrative costs.

Initially, the competence of the organizational units established in the structure of the parent company responsible for financing the investment activities of holdings and financial companies is usually limited.

In subsequent years of work, competencies are often expanded due to new departments.

One of the motives for the creation of financial companies is to increase the opportunities for raising capital. The presented characteristics of various types of financing of investment activities of corporate groups confirm the thesis that companies related to capital can use a wider range of financing sources than independent organizations.

Working together as a group provides additional advantages such as lower financial risk, lower cost of capital, and increased financing opportunities for investments that exceed the opportunities of a separate company.

If you are looking for new sources of financing for investment activities,

ESFC is ready to offer large long-term loans of 50 million euros or more.

We offer our partners comprehensive financial and legal support around the world.

Contact us to learn about the benefits of our model for your corporate group or holding.