Investment lending for large projects and business

GCAM Investment Group offers:

• Investment financing from €50 million and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Loan guarantees

It is important for the initiators to coordinate financing with the specific stages of the project and the company's ability to repay its debt.

Financing of large projects can be carried out using own assets, investment lending, venture funds or leasing.

Investment lending for large projects may be the only chance for some companies to finance new investment projects and develop their activities.

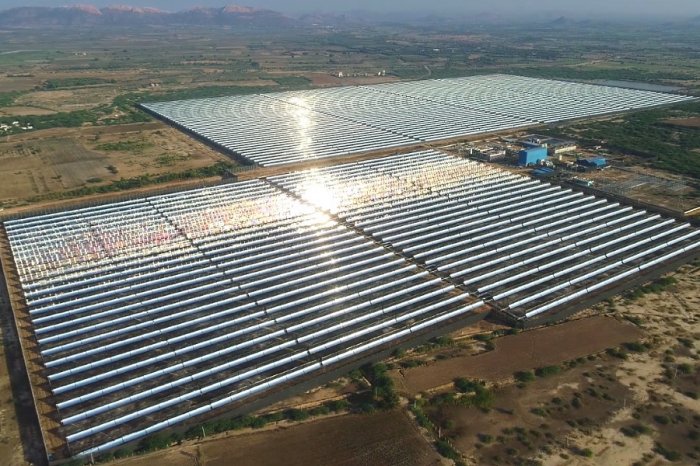

GCAM offers financing for projects in the energy, mining and processing of minerals, waste management, agriculture, heavy industry and mechanical engineering, infrastructure projects, real estate and tourism around the world.

Investment lending: what is it?

Given the limited opportunities for public investment in some countries, leverage is of paramount importance.External sources of financing for large projects include:

• Investment loans from banks and other local or international financial institutions.

• Funds raised through the issue of bonds and other debt obligations of the company.

• Investment resources attracted by leasing.

• Commercial loans provided by suppliers of equipment and other goods to contractors.

• Investment tax credit and other sources.

The history of investment lending goes back hundreds of years.

At the beginning of the twentieth century, Joseph Schumpeter, in his "Theory of Economic Development" (1912), considered credit as the most important condition that allows entrepreneurs to use existing production factors to create new types of products and entire industries.

The renowned economist emphasized the important role of investment loans, since they are clearly innovative in nature, stimulate the development of companies and increase their profitability.

Lending can be considered innovative in such cases:

• Funds encourage companies to invest in intangible assets and conduct research and development.

• Lending contributes to qualitative changes in the production process, changing technologies, organization of production and management.

• Funds are provided exclusively for a specific investment project.

Banks are most willing to finance investment projects with a short payback period.

For this reason, it is most difficult for companies to obtain an investment loan for the construction of a new factory or power plant, which will begin to generate stable cash flow only after a few years.

After commissioning, the profitability of production in the first months is generally low.

Banks, fearing the risks of long-term implementation of the project, rarely provide long-term loans from their own resources. However, they are more willing to provide loans with public funds or foreign support.

Project finance

The terms "investment lending", "project lending" and "project finance" are often used by economists in the context of financing investment activities.Historically, the first deal, which was later called project finance (PF), was struck in the 1930s in the United States to finance an oil refinery.

Until the 1980s, energy and resource projects, especially oil development, dominated the project finance market. In the 1990s, the PF developed rapidly in the electric power industry and infrastructure.

The driver of the development of project finance at the beginning of the 21st century was the internationalization of the global financial and investment markets, as well as the privatization of public infrastructure in developed countries.

Currently, project finance is widely used in the fields of renewable energy, transport, oil and gas industry, real estate and tourism, petrochemical industry.

The term "project finance" means the financing of investment projects, in which the main security for bank loans is the cash flows generated by the future enterprise. Since the leading form of financing is considered to be bank lending, some authors have identified the terms "project finance" and "project lending".

The share of credit funds in project finance remains quite high, reaching 70%.

The share of public-private partnerships is up to 25%.

Project finance is used primarily for complex, socially significant projects requiring significant investments (usually over 200 million euros). Under PF, various financial models are used, selected taking into account the specifics of the project. Various sources of financing are attracted here, including bank lending, participation of a financial institution in the capital of an SPV, issue of bonds, etc.

Competent combination of various financial instruments allows clients to best adapt financial sources to the specific needs of an investment project.

In accordance with the principles of project finance, investors assess the project's ability to generate constant financial flows, which should become a source of debt repayment.

Thus, assets that are formed during the implementation of the project act as collateral for the loan. In most cases, a special purpose vehicle (SPV) is created for the project, which attracts funds.

This minimizes the impact of unforeseen circumstances associated with the activities of the initiator. SPV makes an investment project more transparent in terms of distribution of cash flows and risks.

Investment lending plays an important role in financing large-scale investment projects.

This implies lending to the borrower's capital expenditures in order to ensure quality development, increase production efficiency and business value.

In case of investment lending, the source of debt repayment is the entire economic activity of the client, including income generated during the implementation of the project.

The amount of the loan is determined by the needs of a specific project, taking into account the client's participation and the availability of collateral. If the future income of the project is planned as the only source of loan repayment, the borrower is usually the SPV.

This approach contributes to the optimal distribution of financial risks and responsibilities associated with the implementation of the project.

Investment project life cycle

The study of the procedure for obtaining an investment loan, which has developed in the practice of the world's leading banks, allows us to talk about a clear correspondence of the stages of lending to the stages of the project life cycle.Table: investment lending and project life cycle.

| Phases | Investment project life cycle | Investment lending |

| Pre-investment phase |

|

|

| Investment phase |

|

|

| Operation phase |

|

|

| Liquidation phase |

|

|

International financial company GCAM is ready to provide professional financial and engineering services to your business at any stage of the investment project.

Contact our consultants to find out more.

Investment lending for large projects as a way of business development

An investment loan is a type of loan provided to a business to finance new capital-intensive projects.As a rule, these are significant investments.

To gain access to investment lending, the recipient's own contribution is usually required, which in most cases amounts to 20-30% of the total project cost. Some financial institutions cover up to 90-100% of the investment cost of the project.

GCAM provides financing for large projects with the initiator's own contribution of up to 10%.

The loan can be provided both for a newly established company and for companies that have been on the market for many years.

In most cases, European banks recognize a company as reliable if it has worked on the market for at least 6 months.

Provided financing can be short-term (up to 1 year), medium-term (1-3 years) and long-term (up to 20 years).

An investment loan can only be used for investment purposes, including the following expenses:

• Property that will be owned by the company.

• Special equipment and machines used for production.

• Copyright, patents, licenses and know-how.

• Securities.

The main goals that can be achieved using investment lending are classified by economists into three main groups:

• Material investments such as the purchase of real estate, company cars, machine tools or special equipment needed to grow the business.

• Intangible and legal investments, including the acquisition of copyrights, trademarks, patents, know-how, licenses, which are necessary for the functioning of the company.

• Financing. For example, buying long-term securities, including shares of other companies.

A distinctive feature of investment lending is that they are issued to fulfill clearly defined plans.

Any entrepreneur can apply for an investment loan if he has a good credit history and is ready to invest his own funds, at least 10% of the planned investment.

A well-prepared business plan is a prerequisite for obtaining a loan.

The loan amount depends on many factors, which are considered individually. Both the needs of the enterprise and its financial condition are taken into account. The bank can offer a one-time disbursement of the entire requested amount, as well as its payment in tranches.

The latter solution is especially suitable for projects implemented in several stages (for example, construction or modernization of a production hall).

How to get a large investment loan?

Our clients are often interested in the conditions that an entrepreneur must fulfill in order to obtain an investment loan.Companies wishing to develop large projects in the energy, oil and gas sector, infrastructure or agriculture often apply for investment loans. Not all applicants can count on a positive decision from the bank. Below we will indicate what requirements the company must meet.

An entrepreneur wishing to access bank investment lending must meet the following requirements:

• High creditworthiness, which depends on the requested loan amount requested by the company from the financial institution.

• Flawless credit history, which can be verified through the credit bureau in your country.

• Availability of certain assets to make your own initial contribution in the amount of 10% of the cost of the project. This percentage also depends on the risk that the bank faces in case of investment failure.

• A promising investment project, which is supported by a reliable business plan. The entrepreneur must provide documents confirming the feasibility and financial efficiency of the future project.

To obtain an investment bank loan, you must submit the relevant documents and applications to the selected bank.

Their number and list may differ depending on the institution.

To increase the chance of a positive decision of the bank, it is necessary to carefully prepare a business plan for this project. It is also necessary to prepare documents that reflect the financial health of the company.

When deciding on lending to a business, the bank analyzes the planned project in terms of the chance of success and the possibility of making a profit. The current economic situation is also taken into account.

It makes sense to publish detailed financial analysis and forecasts.

The bank may refuse to issue a loan if it considers that the project was planned inaccurately and the risk is too high.

Advantages and disadvantages of investment lending

Not every company has financial resources that will cover the cost of an investment project.Lack of free financial resources usually means abandoning many projects that could positively affect the development of the company and, thus, increase its income.

With financial support from large banks, you will be able to carry out further investment projects necessary in an era of growing competition. Companies must invest in new products, new technologies, new industries, better equipment. Investing in development ensures the maintenance of a competitive position in the market and growth of the business.

Investment bank lending for large-scale projects may allow adjustment of financing conditions in accordance with the borrower's capabilities and the project's cash flows.

Flexible conditions to a certain extent prevent problems with the company's financial liquidity caused by the implementation of capital-intensive projects.

Thanks to the competent combination of borrowed funds from several sources, even large and expensive projects do not significantly worsen the financial health of the company.

An investment loan is usually provided for a long term.

However, remember that this period does not exceed the depreciation period of the fixed assets that make up the investee (for example, purchased cars, equipment or real estate).

Advantages

Investment lending for many companies is the only solution to ensure business growth.The most important advantage of an investment loan is a large amount of financing.

It happens that banks do not set an upper limit on the loan amount.

The financing provided can be the key to success for a young company, giving the business a huge competitive advantage and becoming the driving force behind its development.

The long term of the loan allows the borrower to tailor financing to a specific project.

Early repayment of the loan is possible, as well as periodic grace periods for debt repayment.

To obtain a loan for the implementation of large investment projects, it is necessary to provide a business plan and financial indicators of the company, including current revenue and projected profit. Banks carefully analyze all applications and check the chances of success of a particular project.

Investment loans are provided only to companies that, according to the bank, are considered reliable and have good prospects for the future.

Receiving such financing is a kind of confirmation of the high potential of the business.

Despite the seeming complexity and laboriousness, investment lending today has become a popular solution for many companies.

Disadvantages

Like any other financial product, an investment loan for the development of large projects has some drawbacks.The biggest drawback is by far the very difficult access for new companies.

For a company to be trusted by the bank, it must successfully operate on the market for at least 6-12 months. Therefore, it is often possible to attract project financing for new companies only through alternative financial instruments.

Another drawback is the relatively long processing time of the application, which is preceded by the collection of a significant amount of documentation about the company and its activities. Some companies for which interest rate risk is important may also view variable interest rates as a disadvantage.

Another problem may be the need for an initiator's contribution and collateral.

Bank loans for large investments

The participation of banks in the investment process involves the mobilization of funds for investment purposes, the issuance of large loans, investment in securities and equity participation.Bank investment loans have sufficient profitability with high risks.

So, investment bank lending is a long-term service available to customers who have promising ideas for improving or opening a new direction in their business.

Principles for providing bank investment loans:

• A clear delineation of functions and responsibilities between the credit and investment structural divisions of the bank, which should help to optimize the relationship between the bank and clients in the investment area.

• Optimization of the investment lending procedure, which makes it possible to improve the process of granting and repaying an investment loan in accordance with specific phases of the life cycle of an investment project.

• Unification of the procedure for obtaining an investment loan in all large commercial banks with the creation of a number of clear criteria that determine the terms of lending.

• Priority of innovative projects due to the need for continuous technical development and business modernization.

• Analysis of the creditworthiness of borrowers, as well as forecasting the characteristics of future cash inflows in the long term.

• The effectiveness of investment lending mechanisms for the bank and borrowers, contributing to the balance of interests of the parties to the loan agreement for the successful implementation of the investment project.

• Applying a proper procedure for granting investment loans in accordance with international guidelines.

Implementation of these principles of bank investment lending for large-scale projects provides a favorable environment for managing credit risk.

If you are interested in investment lending for large projects, contact GCAM.

We offer financing on the most favorable terms with an initiator's contribution of up to 10%.

Securing investment loans

A characteristic feature of investment lending is that the loan cannot be blank (unsecured).Consequently, banks will always use some form of securing investment loans, such as bank guarantees or collateral.

The main ways to secure investment loans are listed below:

• Collateral. Most often, the loan is secured by liquid assets owned by the borrower's company, SPV or third parties. In cases of project finance, project assets can be used as collateral (for example, a facility under construction, equipment, materials, etc.)

• The guarantee can be used in various forms. Firstly, a payment guarantee is an unconditional obligation to transfer certain funds to the bank in case the borrower violates the terms of the agreement or other guarantee events. Secondly, it can be a project completion guarantee containing the sponsors' obligation to continue the implementation of investment plans in certain circumstances. Thirdly, it may be an additional guarantee in the form of a bank deposit of the sponsor or the companies implementing the project.

• Assignment (cession) of claims and accounts to a third party in favor of the bank.

• Insurance agreement and other options.

The cost of an investment loan collateral for large projects may vary, but in general its ratio to a loan is set at 2:1.

The asset provided by the borrower as collateral must be highly liquid, suitable for long-term storage, and easily accessible for control.

Cultural property, charitable organization assets and certain other objects (as defined by the legislation of the host country) cannot be loan collateral.