After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

In this article we explore the world of modern investment consulting firms, shedding light on their role in investment process, strategies, and client-centric approaches.

If you are looking for a reliable consulting and financial services provider for a large project, contact GCAM Investment Group. Our team is ready to provide you with comprehensive support at all stages of the project, including financial modeling, attracting financing, organizing project finance schemes, negotiating and much more.

The geography of our services covers Europe, Latin America, North America, the Middle East and Southeast Asia. For detailed information please contact us.

Understanding an investment consulting firm

Investing in modern financial landscape requires a deep understanding of market dynamics, risk management, and a well-thought-out strategy.Many individuals and businesses turn to investment consulting firms to navigate this terrain. Professional advisors play an increasingly important role in investment process, offering a wide range of services that cater to the unique needs of their clients.

The investment process involves several key participants, each playing a distinct role. This circle includes brokers, banks, regulators, rating agencies and so on At the core are the investors, who seek to grow their wealth or achieve another goals. Investment consulting firms occupy a prominent place in this process as trusted advisors, providing expert guidance and tailored strategies.

A consulting firm in the context of investment process is a specialized advisory organization that offers expert guidance and strategic counsel to individuals, businesses, and institutions looking to make informed and optimized investment decisions.

The term "investment consulting firm" emerged in the 20th century as the investment landscape grew increasingly complex. The origin of investment consulting can be traced back to the need for institutional investors, such as pension funds and endowments, to navigate the intricacies of managing their assets. These organizations required specialized advice to make investment decisions, manage risks, and meet their financial obligations.

The industry began to formalize in the mid-20th century with entities like A.G. Becker and Callan Associates. These pioneering firms provided a range of consulting services to institutional investors, offering assistance in creating investment policies, conducting manager searches, and crafting diversified portfolios to increase the efficiency of the investment process.

The role of consulting firms has evolved in tandem with changes in global investment landscape. Early investment consultants primarily provided advice on asset allocation and manager selection.

However, their role has expanded significantly over the time:

• Broadened service offerings: Investment consulting firms have diversified their services to include risk management, performance monitoring, and compliance. They now offer holistic solutions that encompass the entire investment process.

• Advanced client demographics: Initially serving institutional clients, consulting firms now cater to a broader client base, including individuals, family offices, and smaller institutions. This expansion has necessitated more personalized and flexible approaches.

• Technology integration: The adoption of sophisticated technologies, such as data analytics and portfolio optimization tools, has transformed the way consulting firms operate. They can now provide more data-driven and efficient solutions.

Three huge milestones have marked the development of the investment consulting industry:

1. 1950s-1960s. Pioneering firms were founded, offering investment consulting services to institutional clients. These firms played a vital role in shaping the industry.

2. 1970s-1990s. Investment consulting services across the world continued to expand its influence as pension funds and endowments increasingly relied on consultants to guide their investment decisions. Technical and methodological innovations like the introduction of the Morningstar Style Box (1992) helped in the manager selection process.

3. 2000s and beyond. The 21st century saw investment consulting firms adapting to a rapidly changing financial landscape. They began offering specialized advice on emerging areas like environmental, social, and governance investing (ESG) and alternative investments.

Investment consulting firms have experienced significant growth over the decades.

Today, they serve a broad clientele, including pension funds, foundations, high-net-worth individuals, and more. Currently, the list of largest consultants includes numerous prominent brands worldwide, such as BlackRock, Vanguard Group, Morgan Stanley, Fidelity and JPMorgan Chase.

Investment consultants exert significant influence on the strategies and choices of large institutional investors. Their professional recommendations drive decisions about asset allocation, investment manager selection, and risk management, impacting the financial health of pension funds and endowments. Many of these firms have expanded their services to include not only traditional investment consulting but also advice on environmental, social and governance investing, risk management, and alternative investments.

Investment consulting firms are currently operating at the intersection of financial theory and practical application, providing clients with advice and strategies that are theoretically sound and tailored to their unique financial goals and circumstances.

The role of consulting firms in the investment process includes, but is not limited to:

• Investment strategy development

• Risk assessment and management

• Due diligence and investment selection

• Performance monitoring and reporting

• Adaptation to market changes

• Education and empowerment

Generally, consulting firms offer the flexibility to adapt to changing market environment and empower clients with the knowledge they need to make informed financial decisions. In a world where financial markets are ever-evolving and full of uncertainties, consulting firms play a pivotal role in helping investors achieve their financial goals and secure their financial future.

Key financial theories guiding investment consulting

Investment consulting is actually based on several fundamental financial theories and concepts.They provide the analytical framework and principles upon which investment consultants base their new recommendations. Understanding these theories is essential to appreciate the foundation of investment consulting and how they guide decision-making.

Modern Portfolio Theory (MPT)

Modern portfolio theory, developed by Harry Markowitz in 1950s, is a cornerstone of investment consulting. It posits that investors seek to maximize returns for a given level of risk or, conversely, minimize risk for a given level of return.Investment consultants use MPT to construct diversified portfolios that combine assets with different risk-return profiles. This diversification is based on the principle that risk can be reduced by spreading investments across different asset classes. Consultants aim to identify the optimal mix of assets that will provide the highest expected return for a specified level of risk.

Efficient Market Hypothesis (EMH)

EMH, formulated by Eugene Fama in 1960s, asserts that financial markets are informationally efficient. In other words, asset prices reflect all available information, making it nearly impossible for investors to outperform the market.Investment consultants consider EMH when advising clients on the choice between active and passive investment strategies. Efficient market hypothesis suggests that, in an efficient market, it is challenging to beat the market through active stock picking or market-timing. Consultants may recommend low-cost, passive investment strategies, such as index funds or exchange-traded funds (ETFs), that seek to match market returns.

Risk management concepts

Risk is an inherent aspect of investing, and investment consultants must effectively manage it. Consultants consider various types of risk, including market risk, credit risk, liquidity risk, and operational risk. This is directly related to the success of the investment process.Theoretical models and risk management concepts inform the strategies employed by investment consultants to assess and mitigate risk.

For instance, consultants use available operational historical data, volatility measures, and Monte Carlo simulations to estimate potential portfolio losses and ensure they align with clients' risk tolerance. Consultants also design risk management strategies, such as diversification, asset allocation, and hedging, to protect portfolios.

Behavioral finance concepts

Behavioral finance is a wide field that explores how psychological biases and emotions influence investment decisions. It challenges the assumption of rationality in traditional finance theory and recognizes that investors often act irrationally.Investment consulting firms draw from insights in behavioral finance to guide clients in making rational, long-term investment decisions. They help clients identify and avoid common behavioral pitfalls, such as emotional reactions to market volatility or overconfidence in investment choices. Consultants use these insights to promote discipline and adherence to a well-thought-out strategy.

These theoretical frameworks shape the core strategies and advice offered by consulting firms:

• Asset allocation: MPT guides the selection of assets in a portfolio, aiming to create a mix that balances risk and return, aligning with the client's risk tolerance and objectives.

• Investment strategy: EMH informs the choice between active and passive investment strategies, and it influences whether a consultant recommends actively managed funds or passive index-based funds.

• Risk management: The principles of risk management derived from theoretical models help investment consultants assess and mitigate various risks in client portfolios, ensuring they remain in line with the client's risk appetite.

• Behavioral coaching: Insights from behavioral finance assist consultants in guiding clients to make rational, long-term investment decisions, avoiding behavioral biases and pitfalls.

In essence, these financial theories provide the theoretical underpinning that supports the strategies and advice given by consulting firms during the investment process. By integrating these concepts, consultants aim to optimize investment portfolios, manage risk, and help clients achieve their goals.

Main tasks of modern investment consulting firms

Investment consulting firms are primarily engaged in the business of providing expert guidance and support to individuals and organizations seeking to navigate the world of international finance and investment.Their core responsibilities revolve around designing and managing investment strategies that are tailored to clients' financial objectives. These companies employ a range of financial instruments and models to perform these tasks effectively.

The list of maim tasks of consulting firms in the investment process includes the following.

Client assessment and goal setting

Professional investment consultants start by comprehensively understanding the client's financial situation, objectives, risk tolerance, and investment time horizon. This step is crucial for tailoring investment strategies to meet the client's needs. A survey by CFA Institute found that 55% of clients cited goal-based planning as a significant value-added service offered by investment firms.Asset allocation and strategy development

Investment consulting firms use the client's financial information to determine the best possible mix of asset classes, such as stocks, bonds, real estate, and cash, to achieve specific financial goals. This strategy outlines the framework for the client's investment portfolio. According to a study by Vanguard, proper asset allocation can account for 88% of the variation in a portfolio's returns.Market research and due diligence

Investment consultants and consulting companies perform thorough market research to identify promising investment opportunities. They conduct due diligence to assess the potential risks and returns associated with each investment option. Professional consultants often have access to proprietary research and insights, giving clients a competitive edge.Risk assessment and management

Investment consulting firms evaluate various types of risk, including market risk, credit risk, and liquidity risk. They develop various risk management strategies to mitigate these risks, aligning the portfolio with the particular client's risk tolerance. A study published in the Financial Analysts Journal showed that professional risk management can lead to improved risk-adjusted returns.Investment selection

Consultants use their financial knowledge and expertise to choose specific investment vehicles, such as mutual funds, exchange-traded funds (ETF), individual stocks, or alternative investments, that best fit the client's strategy and risk profile. Well-known consulting firms with wide business networks often provide access to a wide range of investment vehicles, including alternative investments, that may not be readily available to individual investors.Performance monitoring and reporting

Investment consulting firms continuously track the performance of the client's portfolio, comparing it to predetermined benchmarks. Regular reports are generated to provide the client with insight into portfolio performance. A report by PwC found that 93% of institutional investors rely on performance reporting to make investment decisions.Effective cost management

Cost management refers to the process of evaluating, minimizing, and optimizing the various costs associated with investments in a client's portfolio. This includes explicit and implicit costs, such as management fees, trading commissions, taxes, and transaction costs. Consulting companies assess the fees and costs associated with various investment options and recommend strategies to minimize expenses. Reducing costs can improve overall investment returns.Advising on tax efficiency

Consultants recommend strategies that optimize after-tax returns. This includes tax-efficient investment vehicles, asset location strategies, and tax-loss harvesting. Tax-efficient investing potentially adds 1-2% to annual returns, according to the research by Envestnet PMC.Behavioral coaching

Consulting firms offer guidance to help clients make rational, long-term investment decisions. They help clients avoid common behavioral pitfalls, such as panic selling during sharp market downturns. Another interesting study found that poor investor behavior led to an average annual underperformance of 4.35% over 30 years.Adaptation to market changes

Investment consulting companies provide timely recommendations for adapting the investment strategy to changing market conditions. This may involve rebalancing portfolios, altering asset allocations, or seizing emerging opportunities. During the 2008 financial crisis, consulting firms played a critical role in helping their clients navigate turbulent markets.Regulatory compliance

Professional consulting teams ensure that investment strategies and decisions adhere to relevant regulations, maintaining legal and / or ethical compliance. Regulatory compliance is crucial in the financial industry, with potential legal and financial consequences for non-compliance.Education and empowerment

Finally, consulting companies educate and empower clients with the knowledge and resources to make informed financial decisions. This includes explaining investment concepts, strategies, and the rationale behind recommendations. According to another survey by Fidelity, 92% of financial advisors believe that investor education is important for successful investment process.Investment consulting firms bring these main theoretical tasks to life by leveraging their expertise, experience, and industry knowledge. The specifics of each task may vary depending on the client's circumstances and financial goals, but collectively, they contribute to successful investment outcomes and the client's financial well-being.

Client-centric approach in action

Consulting firms distinguish themselves by their ability to customize their services. In the highly competitive world of financial services, this approach is fundamental to providing effective advice.The term "client-centric approach" refers to a business strategy that prioritizes the needs, preferences, and well-being of the client above all else. In practice, it means that consulting firms take more time to understand the unique circumstances, goals, and preferences of each client. They then design a tailored strategy that reflects these individual needs. This personalized service is what sets investment consulting companies apart and enables clients to achieve their financial objectives.

Table: Real-life scenarios demonstrating the client-centric approach

|

Real-life scenarios

|

Client profile

|

Client-centric approach

|

|

|

Stage

|

Activities

|

||

| ESG integration for a large institutional investor | A large investor, such as a pension fund or endowment, with a strong commitment to ESG principles. | In-depth ESG assessment | The consulting firm conducts a thorough analysis of the client's ESG values and objectives, understanding the specific ESG criteria and preferences that need to be integrated into the investment strategy. |

| Customized ESG portfolio | A customized ESG investment portfolio is constructed that aligns with the client's ethical principles. The portfolio emphasizes companies with ESG practices and excludes those that do not meet ESG criteria. | ||

| Reporting and transparency | The consulting team provides regular reports and updates that track the ESG performance of the portfolio. This transparency allows the client to assess the impact of their investments on ESG goals. | ||

| Dynamic ESG integration | As the client's ESG objectives evolve or new considerations emerge, the consulting firm adapts the strategy to ensure continued alignment with the client's values. | ||

| Investment strategy for a construction conglomerate | A construction conglomerate with diverse operations, encompassing residential and commercial real estate development, infrastructure projects, and ambitious international expansion plans. | Comprehensive strategic assessment | The consulting firm undertakes a strategic assessment to comprehend the client's short-term and long-term objectives. This encompasses the need for capital to fund ongoing construction projects, acquisitions, and expansion into new markets. |

| Customized portfolio diversification | Recognizing the client's diverse business lines and global operations, the consulting team crafts a tailored investment portfolio that balances the need for liquidity, capital growth, and risk mitigation. This portfolio may include a mix of liquid assets, real estate holdings, and fixed-income securities to align with the client's financial objectives. | ||

| Global market expertise | Given the international expansion plans, the consulting firm provides expertise in assessing opportunities and managing currency risk. The investment strategy considers the client's global footprint and incorporates region-specific opportunities and challenges. | ||

| Regular review and adaptation | In the construction industry, market conditions and project timelines can change rapidly. The consulting team conducts periodic reviews and remains flexible, adapting the investment strategy to accommodate evolving circumstances and capital requirements. | ||

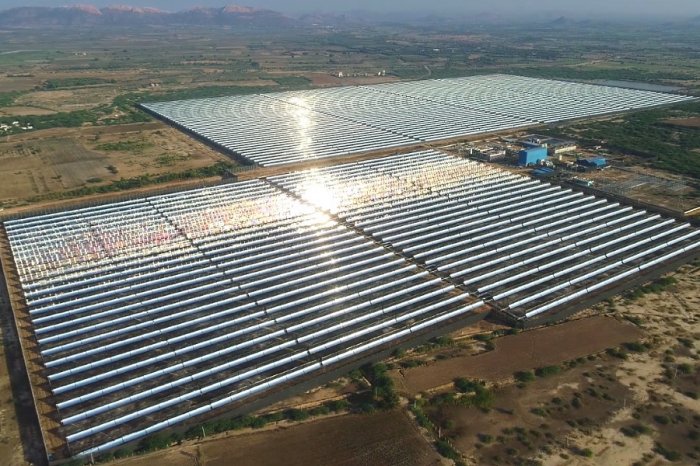

| Investment strategy for a renewable energy corporation | A large renewable energy company involved in various clean energy projects, such as solar and wind farms, and keen on expanding its portfolio. | Comprehensive energy portfolio assessment | The consulting firm conducts an in-depth analysis of the client's existing RES portfolio, considering factors like project lifecycles, expected energy production, and the need for capital to support future expansion. |

| Customized investment portfolio | Recognizing the client's mission to drive RES adoption, the consulting team designs an investment portfolio with a focus on renewable energy projects. This includes investments in solar and wind energy, energy storage solutions, and emerging clean technology companies. | ||

| Regulatory expertise | The investment consulting firm provides regulatory insights, helping the client navigate the landscape of renewable energy incentives, tax credits, and compliance. The investment strategy integrates these regulatory considerations to maximize returns and incentivize further clean energy development. | ||

| Global expansion strategy | In line with the client's expansion plans into new geographic markets, the consulting team offers guidance on assessing market opportunities, risks, and regulatory compliance on an international scale. The strategy is adapted to reflect the client's global footprint and growth aspirations. | ||

| Environmental impact assessment | Given the client's commitment to environmental sustainability, the consulting firm conducts a comprehensive assessment of the environmental and social impact of each investment. The investment strategy aims to align with the client's values and support clean energy initiatives that have a positive impact on the environment. | ||

| Regular review and adaptation | The renewable energy sector is dynamic, with evolving technology, market conditions, and regulatory changes. The consulting team must conduct periodic reviews and remains very flexible in adjusting the strategy to respond to market dynamics and the client's evolving needs. | ||

In the above scenarios, the client-centric approach highlights the manner in which successful investment consulting firms tailor their services to meet the unique financial needs and industry-specific challenges of their clients.

The emphasis is on personalized strategies that align with the client's objectives, values, and business complexities while adapting to its dynamic nature.

Challenges and ethical considerations faced by investment consultants

Modern investment consulting firms encounter several challenges in their pursuit of providing sound financial advice during the investment process.These challenges include the following:

• Market volatility: Fluctuations in financial markets can make it challenging to provide stable, consistent advice. Consultants must navigate market ups and downs while keeping clients on track toward their goals.

• Regulatory changes: Evolving financial regulations impact consulting practices. Staying compliant with regulatory requirements and adapting to new standards can be complex.

• Client expectations: Meeting diverse client expectations is always demanding. Clients may have different risk tolerances, goals, and preferences, making personalized advice necessary.

• Investment complexity: As investment products become more intricate, consultants must continually update their knowledge to understand and recommend these options effectively.

• Technological disruption: The integration of advanced technologies, like robo-advisors and AI-driven services, presents serious challenges. Consultants need to adapt to remain competitive and provide value beyond what automation offers.

In international investment consulting, ethics play a critical role in shaping the relationships between consultants and their clients.

The ethical framework that underpins this profession is multifaceted and goes beyond mere guidelines. Consultants must maintain the highest ethical standards to build trust with clients and protect their interests.

Key ethical considerations include:

• Fiduciary duty: Consultants have a fiduciary duty to act in their clients' best interests. This means putting the client's financial well-being ahead of any personal or company interests.

• Conflict of interest: Investment consultants must identify, disclose, and manage conflicts of interest. For example, they must disclose if they receive any compensation or incentives from recommending specific investment products.

• Full disclosure: Transparency is vital in this business. Consultants should provide clients with comprehensive information about fees, investment strategies, and any potential risks associated with their recommendations.

• Client confidentiality: Maintaining client confidentiality is another ethical obligation. Consultants must protect clients' sensitive financial information and not disclose it.

• Competence and education: Investment consultants are ethically bound to maintain their professional competence through ongoing education and training.

Practice shows, that investment consulting firms face numerous challenges related to financial and market volatility, adaptation to regulatory changes, and evolving client expectations. They must navigate these challenges while upholding ethical standards.

Regulatory compliance and adherence to industry standards are also important to maintaining trust and ensuring clients' well-being.