After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

This financial instrument not only supports countless startups, but also significantly contributes to the formation of new industries and technological revolutions.

Against the backdrop of global development, venture capital has become particularly relevant and has become a key element of innovation ecosystems.

The essence of venture capital services

Venture capital is a form of financing in which investors (usually venture capitalists or venture capital funds) provide financial support to start-ups and young companies with high growth potential.This type of investment is usually associated with risky projects, but with successful development, they can bring high returns.

Venture capital often reflects current global business trends. In recent years, for example, there has been an increase in interest in sectors related to artificial intelligence, blockchain, green energy and healthcare. This type of capital has a global impact, and venture funds can invest in companies located in different countries. It facilitates the international exchange of ideas and techs.

Large investors understand that they carry high risks, but also have the potential for high returns. Successful investments in startups can bring multiple returns, offsetting losses from unsuccessful projects.

Venture capital is an important part of the startup ecosystem.

It promotes the creation and development of innovative companies, as well as provides them with access to the necessary resources. Different countries have different laws and regulations regarding venture capital. This may include registration requirements for venture capital funds, investment rules, and even tax considerations.

Here are some general aspects of venture capital and related services:

• Startup funding. Venture capitalists provide funding to startups to help them grow, scale, and reach new heights. These investments can be used for product development, marketing, recruitment, and other operations.

• Advice and mentoring. Venture capitalists often provide strategic guidance and advice to startups. They may have business experience and knowledge that will help startups avoid mistakes and make the right decisions.

• Networking resources. Venture capitalists can provide startups with access to their professional networks, which can help them find new clients, partners, and investors.

• Risk management. Venture capitalists understand that startups carry high risks and are willing to take them on. They invest in several companies, knowing that not all of them will be successful, but at the same time hoping that one or more of them will bring a large profit.

• IPO or acquisition stage. The goal of VCs is often to go public with an IPO or sell the company to another major player. This is the moment when a venture investor can get a return on their investment with a profit.

• Areas of interest. Venture capital funds often focus on specific industries or technologies, such as information technology, biotechnology, clean energy, and others. This allows them to invest their resources and expertise in certain sectors.

Venture capital can be divided into different stages of financing, including the first stage (seed), the enterprise stage (series A, B, C, and so on) and the IPO stage. Each stage has its own characteristics and requirements, and venture capitalists can specialize in specific stages.

International practice shows, that venture capital plays a key role in the development of innovations, supporting startups at different stages.

It provides not only financial support, but also valuable resources, expertise and contacts to help young companies succeed and stimulate their growth.

Global role and impact of venture capital

The global impact of venture capital services is backed by facts, figures, company names and brands.The following facts and examples highlight the important role of venture capital in the global economy and innovation and its ability to shape the future.

In 2022, global venture capital investments reached $445 billion. Major venture capital players included companies and funds such as Sequoia Capital, Andreessen Horowitz, SoftBank Vision Fund and many others. Companies that have received early backing from VCs include internationally renowned giants such as Google, Facebook, Amazon, and Alibaba.

Venture capital has played a key role in the development of new technologies such as artificial intelligence, blockchain, biotechnology and electric vehicles. For example, Tesla, which received support from venture investors, revolutionized the market for electric vehicles.

Cities like Silicon Valley, New York and London have become global hubs for innovation and start-up companies thanks to venture capital.

Venture investments help create millions of jobs around the world.

For example, Amazon said that the company created more than 400,000 jobs in 2020.

VCs support the development of new industries and helps increase economic growth. In the United States, venture-backed startups account for over 20% of GDP. Venture capitalists and startups often work globally, collaborating with companies and investors from different countries. This facilitates the exchange of knowledge and technology between different regions.

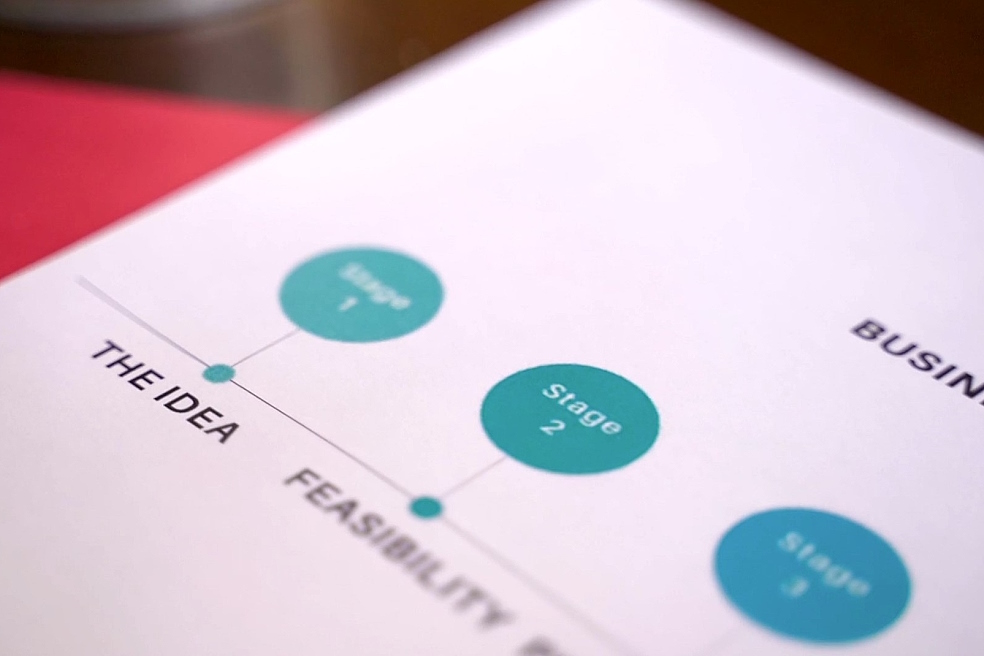

Stages of financing venture projects

Financing of large venture projects goes through several typical stages, starting from the very early pre-seed stage and ending with the stage of entering the public market or a deal with the investor.It is important to note that the names of the stages and their nature may vary slightly in different regions and industries, but the overall structure remains the same.

Pre-seed stage

This stage is the earliest. Usually co-founders of the company pass it, using their own financial resources or funds from personal contacts. The main goal at this stage is to create a concept and prototype of the product, as well as to conduct initial market research.Seed stage

At this stage, the startup is looking for funding to develop its product and start scaling. Investors in the seed stage can include angel investors as well as small venture capital funds. The main task is to prove the concept, attract the first customers and prepare for the next stage.Enterprise stage

At this stage (series A, B, C and so on), the company has already proven its worth and is ready to scale the business. This stage typically involves raising large amounts of funding from venture capital funds and serious institutional investors. The goal is to increase market share, strengthen marketing and sales, and expand the professional team, laying the foundation for future success.Exit process

This stage is essentially an event where investors get their investment back with a profit. One of the possible ways is to enter the public market through an IPO (initial public offerings). Another option is the sale of the company (acquisition) by another large company.Each stage has its own characteristics and requirements:

• Series A onward: These stages typically require a higher degree of proof of success and more detailed business data.

• Seed stage and series A: the emphasis is usually on the team and the idea, as well as the potential for future growth.

• Exit process: This is the final stage where investors hope to make significant profits.

Each stage of financing venture companies includes several rounds of investments. Companies may overlap with stages, depending on their growth and needs. The size of investments and the structure of financial transactions can also vary greatly depending on the region and particular industry.

The largest venture investment projects in the world

Venture capital services act as the driving force behind innovation around the world, supporting the birth and growth of hundreds of thousands of startups.These projects not only transform industries, but also make significant contributions to the global economy. Venture investors support innovative entrepreneurs and companies, providing them with the funding to realize their ideas.

Let's dive into the world of venture capital and look at some of the most impressive venture capital projects across the world. In this list, we will introduce you to successful and innovative companies that have received significant investment and made a significant impact in the global market.

Table: The most successful examples of the use of venture capital

| Country | Brand | Year | Investment | Description |

| USA | SpaceX | 2002 | $5 billion | SpaceX, founded by Elon Musk, received large venture investments to develop space technology and launch commercial satellites. |

| China | Ant Group | 2014 | $14 billion | Ant Group, which owns the Alipay platform, has received major venture capital investments, becoming one of the largest financial technology companies in the world. |

| India | Flipkart | 2007 | $7 billion | Flipkart, one of the largest online retailers in India, has received significant venture capital investment to boost e-commerce across the country. |

| UK | Revolut | 2015 | More than $900 million | Revolut, a fintech startup with a focus on banking and payments, has received a slew of venture capital investments to scale its business. |

| Israel | Mobileye | 1999 | Acquired by Intel for $15.3 billion in 2017 | Mobileye, which specializes in developing systems for autonomous cars and safety systems, became the largest venture capital deal in Israel. |

Venture capital and accelerator services

GCAM Investment Group is currently a dynamic force in the world of investment, specializing in nurturing and propelling the growth of companies that not only align with our beliefs but also fall within the realm of our expertise.Our value proposition includes the following:

• Diverse financing options. We offer a myriad of financing avenues, including direct investment and embracing the concept of sweat equity.

• Market penetration. We embark on the journey of optimizing corporate structures, elevating the professionalism of board functions, and preparing companies for the impending phases of growth.

• Accelerating business dynamics. Our forte lies in creating value by not just establishing but also expeditiously advancing businesses to their zenith.

• Seamless turnkey operations. We provide turnkey operations, reinforced by professional on-the-ground support to ensure success in various operational facets.

Beyond the financial aspect, we open the doors to a treasure trove of knowledge within GCAM, operational mastery, and an extensive network of resources spanning European markets and beyond.

Our commitment to fostering growth knows no bounds, encompassing a comprehensive array of support, ranging from forging strategic partnerships, providing sound advisory services, and execution of specific operations.

What sets us apart

Our investment philosophy is rooted in early-stage business opportunities, where the expertise, operational infrastructure, and expansive network within the GCAM Investment Group can wield transformative power in steering invested companies and projects towards success.This includes, but is not confined to, companies originating in either region and expanding into the other, entities seeking cross-regional capital access, or those with extensive operations and supply chains spanning regions. With flexible financing schemes, we zero in on innovative companies poised to become future industry leaders.

Our investment extends beyond mere capital infusion, as we also furnish comprehensive resources across EU and beyond.