After receiving the necessary documents and project presentation, our team will try to review your request as soon as possible, and leading experts will offer the best options for project funding.

To this end, the initiators of the project create a legally independent company (Special Purpose Entity or Special Purpose Vehicle), which is responsible for the development of the project and attracts borrowed funds, guaranteeing the return of the debt exclusively by the assets of the project.

Project finance as a concept based on the participation of private capital in the implementation of large state and public projects has more than 200 years of history.

Back in the 18th and 19th centuries, England underwent a massive modernization of the road network, using tolls as the main source of repayment of borrowed funds for Italian banks. The development of transport infrastructure, electricity and communications in the 19th century required active participation of private capital, laying the foundation for project finance in Europe.

The age-old desire of business to go beyond the possible in search of new sources of income leads to the creation of unprecedented masterpieces of technical and engineering thought.

One such example was the construction of the Suez Canal, which was made possible by the use of new financial instruments. Nowadays, the funding of international projects has received effective tools to implement grandiose investment ideas.

In 2015 alone, PF accounted for several hundred projects worth about $ 275 billion worldwide.

The experience of recent decades shows that international project finance is applicable to many investment projects. PF can be used both in the real sector of the economy and for large-scale financial projects. This has been proven by the examples of the rapid development of the countries of the European Union, China, the United States, Saudi Arabia and many other successful global players.

The largest private banks and international financial institutions, such as the EIB and the EBRD, actively use PF instruments in their activities.

GCAM Investment Group, a financial company with an international presence, offers funding of large international investment projects by providing long-term loans from € 50 million on flexible terms.

We also offer a full range of engineering, organizational and legal services for large businesses anywhere in the world.

International project finance: theoretical basis

International project finance refers to the cross-border method of realizing capital intensive investments through a legally and financially independent project company (SPV).The complexity of implementing such projects on an international scale is not limited by the legal peculiarities of creating an SPV and providing borrowed funds in different countries. Multilateral contractual relations concluded by partners must reliably protect the interests of creditors and guarantee funding for the project on the most favorable terms.

Although there is no single universally accepted definition of project finance, this method has the following features:

• The initiators create an independent company, the life of which is limited by the period of implementation of a specific project.

• The share of borrowed funds usually reaches 80-90% of investment costs, and all funds are attracted by the project company.

• Project assets include valuable property, the value of which is expected to grow in the long term or which provide an opportunity to enter a promising business.

• The risks of the project are evenly distributed among the participants in such a way as to increase the chances of the success of the entire project.

• The future financial flows of the project must be sufficient to service the debt.

• Financing is provided without recourse or with limited recourse to the borrower.

There is currently no consensus on the superiority of international project financing over other forms of funding such as bank loans.

The main advantage of the PF is non-recourse financing, which allows companies to use a high level of leverage without burdening financial statements with high levels of debt.

Table: Features of international project finance in brief.

| Features | Short description |

| Innovativeness | International project finance is an innovative business finance model. The PF offers members unique benefits that attract lenders despite the lack of collateral. |

| International nature | Contractual relations within the framework of the PF are concluded between numerous partners from different countries, which requires taking into account the requirements of the current legislation and the characteristics of foreign markets. |

| Money against future income | The PF is completely dependent on the future financial flows that a particular project will generate. Thanks to this, the initiating companies do not risk their assets and do not provide material security for loans. |

| Off-balance sheet financing | The off-balance sheet nature of project finance allows companies to maintain high financial stability, since multimillion-dollar debt is not reflected in the reports. |

| High leverage | PF allows you to attract significantly more funds in comparison with traditional funding models. |

| Long term | Funding under the PF is issued on average for a longer period than corporate loans. |

A wide range of PF contractual options allows the initiator to share risks with foreign partners and ensures more efficient project implementation compared to traditional funding methods.

The disadvantages of PF are associated with the complexity of the organization due to the increase in the number of participants in the scheme. PF is associated with higher transaction costs, so the cost of borrowing is usually higher compared to other financial alternatives.

Banks' requirements also include extensive financial, legal and technical analysis of the project.

The essence of project finance covers aspects such as organizational structure, financing and risks.

They are connected and mutually condition each other. The connecting link in this process is the SPV. Special purpose investment companies are created for a specific purpose, which may be, for example, an investment in the modernization of production, the construction of a large facility, or the purchase of real estate.

This is a flexible organizational structure, which primarily allows the companies that initiate the project to obtain loans based on the future income projected from the project.

SPV in international practice is an independent business entity, and all relations with the project participants follow from the general principles of law, concluded agreements and contracts.

Doing business in this form is justified by the peculiarities of large and capital-intensive projects, as well as certain advantages arising from the separation of the company from the sponsors' assets.

The SPV (SPE) has ownership of the assets being funded and the sponsor is not financially liable for the debt of this entity (unless it has provided appropriate guarantees). The investment process is focused on assets created as a result of the project, which are a source of generating cash flows and at the same time protect the interests of investors.

When setting up a special purpose investment company, sponsors should choose a suitable legal form that will determine their impact on company management, control methods, profit sharing, etc.

The choice of the legal form of SPV in international project finance should also be dictated by the need to comply with the number of partners and the size of capital investments, international requirements and the need for public disclosure of performance results.

It is also necessary to take into account the specifics of a particular project and the legal regulations of the host country in which it is being implemented.

The choice of the organizational and legal form of the SPV is one of the key steps in the pre-investment phase of the project development cycle. In many cases, companies prefer joint stock companies or limited liability companies, which have a number of advantages for the initiating companies. In such companies, the participants are liable for the debts of the project solely within the framework of their contribution to the capital of the SPV or its shares.

Placing individual projects in separate project companies means diversifying investment risk.

SPV is also considered to be a relatively safe solution from the point of view of the lender bank.

The bank is confident that a particular company will limit its activities to specific investments only and that the possibilities for securing claims and meeting them are significant. The procedure for a possible bankruptcy of the project is also simplified.

With its ability to carry out large-scale investment activities on multiple fronts, international project finance is well suited to large companies active around the world.

In fact, unlimited opportunities to raise capital allow them to quickly implement promising projects without burdening the company's balance sheet with large debts.

Among the determining factors for choosing an SPV form, it is important to consider maximizing a positive tax effect for both the project company and its sponsors.

Correctly chosen form and structure of its activities can provide significant tax "savings". Both value added tax and numerous corporate taxes and fees applied in different countries of the world are taken into account. In some cases, there is a risk of double taxation at the level of the company's capital and the payment of dividends, which should also be avoided.

In project finance, subordinated capital is also widely used, which, in fact, being external capital, is considered as equity in order to determine the capital structure ratios. This is especially useful in terms of financial engineering and project bank analysis.

As a rule, interest on subordinated loans is not taxed, however, exceptions are possible.

The global project finance market today and tomorrow

The growth of project finance over the past 25-30 years is mainly associated with the global processes of deregulation of the economy.This trend is supported by the ongoing internationalization of investment processes.

During the period from 1991 to 2012, about 6,000 investment projects were implemented using project finance for a total of US $ 2.5 trillion.

Leading investors, consultants and lenders have projects from different countries in their portfolio and successfully use the practical experience gained in other similar projects.

The global financial crisis caused a sharp reduction in lending to government projects and contributed to a shift in project activity towards China and other Asian countries. If in the countries of the Americas, the PF volume in 2015 reached $ 95 billion, while in the developing countries of Asia, the Pacific region and Japan, projects worth $ 75 billion were implemented.

Today, trends are changing again, fueled by geopolitical tensions and unpredictability that have affected a number of regions of the planet and even industries.

However, government projects have repeatedly demonstrated high resilience to financial shocks.

The use of PF has helped to maintain growth in Latin America, Africa, South and East Asia.

This confirms that international project finance is most effective for developing countries with weak business infrastructure and high external capital requirements. Interestingly, a significant proportion of North American and European investment today is directed to high-risk Third World countries.

Analysts believe that international project finance is more about large investments made outside the country by sponsors or investors.

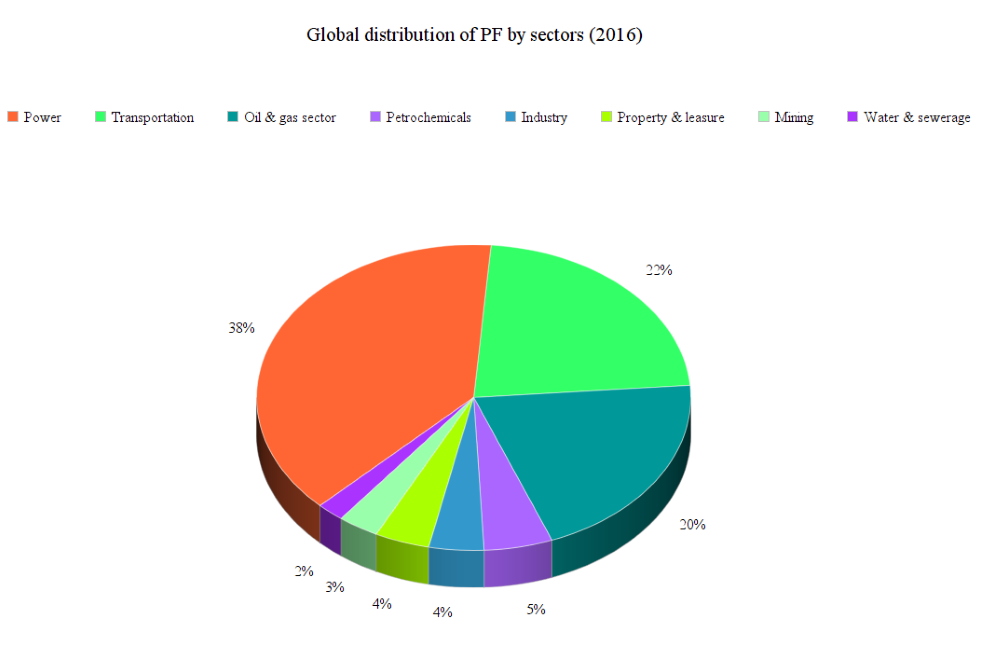

Numerous publications provide us with information on the successful use of PF to refinance already completed projects, including in the energy sector, heavy industry, transport, oil and gas sector and mining. These industries are characterized by high project implementation costs, long construction times and the need to attract numerous suppliers and qualified contractors, often from several countries.

Our financial team is ready to assist you in the implementation of large investment projects anywhere in the world.

We have experience in providing engineering and financial services in dozens of countries in Europe, Africa, the Middle East, East Asia and Latin America.

Contact our consultants and learn more about GCAM Investment Group's opportunities in international project finance.